installyacija.ru Prices

Prices

Ford Future Stock Price

The Ford stock price fell by % on the last day (Thursday, 5th Sep ) from $ to $ It has now fallen 3 days in a row. During the last trading. Ford Motor is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is. Ford Motor stock prediction for 1 year from now: $ (%) · Ford Motor stock forecast for $ (%) · Ford Motor stock prediction for $. On average, Wall Street analysts predict that Ford Motor Co's share price could reach $ by Aug 12, The average Ford Motor Co stock price prediction. On average, F's share price is expected to reach $ This means F may see an increase. Read more about ratings here. How has Ford Motor Company's stock. View research reports from Argus and trade ideas from Trading Central to understand future stock performances and find high performing. The forecasted Ford price at the end of is $ - and the year to year change +32%. The rise from today to year-end: +16%. In the first half of , the. Ford stock price forecast for September The forecast for beginning dollars. Maximum price , minimum Averaged Ford stock price for the. View Ford Motor Company F stock quote prices, financial information, real-time forecasts, and company news from CNN. The Ford stock price fell by % on the last day (Thursday, 5th Sep ) from $ to $ It has now fallen 3 days in a row. During the last trading. Ford Motor is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is. Ford Motor stock prediction for 1 year from now: $ (%) · Ford Motor stock forecast for $ (%) · Ford Motor stock prediction for $. On average, Wall Street analysts predict that Ford Motor Co's share price could reach $ by Aug 12, The average Ford Motor Co stock price prediction. On average, F's share price is expected to reach $ This means F may see an increase. Read more about ratings here. How has Ford Motor Company's stock. View research reports from Argus and trade ideas from Trading Central to understand future stock performances and find high performing. The forecasted Ford price at the end of is $ - and the year to year change +32%. The rise from today to year-end: +16%. In the first half of , the. Ford stock price forecast for September The forecast for beginning dollars. Maximum price , minimum Averaged Ford stock price for the. View Ford Motor Company F stock quote prices, financial information, real-time forecasts, and company news from CNN.

F Analyst Price Target ; High · ; Average · ; Low · The F ("F") future stock price will be USD. Will F stock price crash? According to our analysis, this will not happen. Will Ford Motor. AI Munafa prediction value: 51 as on Wed 28 August · How is AI Munafa prediction value determined? · Stock price target for Ford Motor Company F are on. Real time Ford Motor Company (F) stock price quote, stock graph, news & analysis More on Ford's plans for an electric future and whether it might be a stock. The average price target for Ford Motor Company (F) is $ The current on short-term price targets is based on 7 reports. The forecasts for Ford Motor. Although betting on high-flying assets like CAVA stock may seem risky, the modularity of options adds a wrinkle to this narrative. Farmer holds tablet using. According to the 13 analysts' twelve-month price targets for Ford Motor, the average price target is $ The highest price target for F is $, while the. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Ford stock price forecast for September The forecast for beginning dollars. Maximum price , minimum Averaged Ford stock price for the. View research reports from Argus and trade ideas from Trading Central to understand future stock performances and find high performing. Ford Motor Co F:NYSE ; Close. quote price arrow down (%) ; Volume. 44,, ; 52 week range. - Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - We've gathered analysts' opinions on FORD MTR CO DEL future price: according to them, F price has a max estimate of USD and a min estimate of USD. Ford stock price forecast on Monday, September, 9: dollars, maximum , minimum Ford stock prediction on Tuesday, September, dollars. Ford Motor is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is. Ford Motor Company (F) reachead $ at the closing of the latest trading day, reflecting a % change compared to its last close. Zacks•2 hours ago. marks a crucial year for Ford investors. Based on comprehensive market research, our projections suggest that Ford's stock price is poised to experience. Future price of the stock is predicted at 0$ (0%) after a year according to our prediction system. This means that if you invested $ now, your current. According to analytical forecasts, the price of F may reach $ by the end of , and it is expected to be $ by the end of Based on technical. As of 4th of September , the relative strength index (RSI) of Ford's share price is approaching This usually indicates that the stock is in nutural.

Roth Ira Trading Fees

No load, transaction fee funds: $25 per transaction; Sales charges per the applicable fund prospectus. Fees for trades placed through Wealth Management. $0 per trade is applicable to commissions for online and automated telephone trading of stocks and exchange-traded funds (ETFs). For stock and ETF trades placed. Trading Fees and Commissions · US Over-The-Counter (OTC) Equities · Online Trades. $ · Broker-Assisted Trades. $ + $25 service charge. fees that may be charged by Company X to its IRA and Roth IRA clients that participate in any of the Investment Advisory Accounts described herein. This. Transaction fees are charged each time you enter into a transaction, for example, when you buy a stock or mutual fund. In contrast, ongoing fees or expenses are. ET), plus applicable commission and fees. Directed trades executed through E*TRADE Pro to an ECN during regular market hours and Extended Hours sessions are. E*Trade's Roth IRA doesn't charge any annual account fees or tie account holders to a minimum balance requirement or deposit. And account holders pay $0. Normal transaction fees. Dollar cost averaging. Systematic purchase of that IRA into a new Edward Jones traditional/Roth IRA, your annual IRA fee. E*TRADE from Morgan Stanley ("E*TRADE") charges $0 commissions for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*. No load, transaction fee funds: $25 per transaction; Sales charges per the applicable fund prospectus. Fees for trades placed through Wealth Management. $0 per trade is applicable to commissions for online and automated telephone trading of stocks and exchange-traded funds (ETFs). For stock and ETF trades placed. Trading Fees and Commissions · US Over-The-Counter (OTC) Equities · Online Trades. $ · Broker-Assisted Trades. $ + $25 service charge. fees that may be charged by Company X to its IRA and Roth IRA clients that participate in any of the Investment Advisory Accounts described herein. This. Transaction fees are charged each time you enter into a transaction, for example, when you buy a stock or mutual fund. In contrast, ongoing fees or expenses are. ET), plus applicable commission and fees. Directed trades executed through E*TRADE Pro to an ECN during regular market hours and Extended Hours sessions are. E*Trade's Roth IRA doesn't charge any annual account fees or tie account holders to a minimum balance requirement or deposit. And account holders pay $0. Normal transaction fees. Dollar cost averaging. Systematic purchase of that IRA into a new Edward Jones traditional/Roth IRA, your annual IRA fee. E*TRADE from Morgan Stanley ("E*TRADE") charges $0 commissions for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*.

You may have to pay a commission on the transaction when you trade stocks or Exchange-Traded Funds (ETFs). This could be a fixed fee or a commission based on. Fees typically range from $25 to $50 annually, but vary across providers. Many institutions no longer charge IRA fees, so be sure to choose wisely to avoid. Sales of U.S. listed stocks and exchange-traded funds (ETFs) are subject to a transaction fee of between $ and $ per $1, principal. Purchases and. Online trades are $0 for stocks, ETFs, options and mutual funds. See our Pricing page for detailed pricing of all security types offered at Firstrade. All. KEY BENEFITS · No annual maintenance fee. · $0 commission for online US stock, ETF, and option trades · No transaction fee when trading most Fidelity mutual funds. Retirement account fees. Traditional, Roth, SEP or SIMPLE IRA fee: $ You This regulatory transaction (RT) fee is collected to recover transaction fees. $0 Commissions · Commission-free trading on eligible U.S. stocks and ETFs · Wide selection of commission-free ETFs from market leaders such as Vanguard, GlobalX. Termination Fee applies to full distribution of Traditional, Roth, and SEP IRAs; fee is waived for clients over age 70½ or accounts terminated due to death or. $0 online commission. Sales of U.S. listed stocks and ETFs are subject to a transaction fee of between $ and $ per $1, principal. Options. Competitive and clear Commissions and Fees pricing for your WellsTrade® online investment accounts. Find IRA and brokerage account fees and more. $ commission applies to online U.S. equity trades, exchange-traded funds (ETFs), and options (+ $ per contract fee) in a Fidelity retail account only. Interactive Brokers charges no commissions on stock and ETF trades for its lite tier, which compares well with Schwab and Fidelity, and the broker charges a. $0 trading commissions Pay nothing to trade stocks, ETFs, and Vanguard mutual funds online. Enjoy access to more than no-transaction-fee mutual funds from. $0 trading commissions Pay nothing to trade stocks, ETFs, and Vanguard mutual funds online. Enjoy access to more than no-transaction-fee mutual funds from. Merrill waives its commissions for all online stock, ETF and option trades placed in a Merrill Edge® Self-Directed brokerage account. Brokerage fees associated. But brokerage accounts are taxable, unlike IRAs which are either tax-deferred or tax-free and have rules around contribution and withdrawals. What Is an IRA? An. Normal transaction fees. All fees are subject to change without subsequently transferred that IRA into a new Edward Jones traditional/Roth IRA. For crypto accounts, Betterment charges one low, annual fee which covers all management costs. Additional trading expenses (up to % per transaction) are. $0 per trade is applicable to commissions for online and automated telephone trading of stocks and exchange-traded funds (ETFs). For stock and ETF trades placed. IRA Associated Fees At tastytrade, IRAs are not subject to any account maintenance fees. Additionally, we do not charge any inactivity fees (and that applies.

Borrow $20 Online

* There is a minimum period of 1 day set for the repayment of the loan. Extensions on the repayment period can be availed by contacting our support team. online resources to keep you moving toward your financial goals. Get the $20 loan application fee. Assumes 12 monthly payments of $ per $ Apply for an online loan, get approved in minutes, and get your deposit instantly. For lightning-fast same-day loans, apply at Minute Loan Center today. Legal/disclosures – *$15/$ or portion thereof borrowed; $20 minimum. Rates are determined based on your credit score. Apply Today. close tab. Signature Loans. You could score term life insurance % online. Get a free quote $20K* to open doors to your ambition.. Sponsor: Social Finance LLC. Upgrade. At a flat fee of $20 per $ borrowed, a $ payday loan could cost you Online Privacy Notice and our Online Privacy FAQs. The $20 application fee is charged regardless of approval or loan acceptance. All In Credit Union will not ask for personal information such as online. A $20 origination fee applies and can be charged once every 6 months. Just go to your Online Banking page and make timely transfers to your loan account. Get a cash advance between $20 and $ upon qualification. Then just continue to bank, borrow, and make on-time payments to work up to advances of $! * There is a minimum period of 1 day set for the repayment of the loan. Extensions on the repayment period can be availed by contacting our support team. online resources to keep you moving toward your financial goals. Get the $20 loan application fee. Assumes 12 monthly payments of $ per $ Apply for an online loan, get approved in minutes, and get your deposit instantly. For lightning-fast same-day loans, apply at Minute Loan Center today. Legal/disclosures – *$15/$ or portion thereof borrowed; $20 minimum. Rates are determined based on your credit score. Apply Today. close tab. Signature Loans. You could score term life insurance % online. Get a free quote $20K* to open doors to your ambition.. Sponsor: Social Finance LLC. Upgrade. At a flat fee of $20 per $ borrowed, a $ payday loan could cost you Online Privacy Notice and our Online Privacy FAQs. The $20 application fee is charged regardless of approval or loan acceptance. All In Credit Union will not ask for personal information such as online. A $20 origination fee applies and can be charged once every 6 months. Just go to your Online Banking page and make timely transfers to your loan account. Get a cash advance between $20 and $ upon qualification. Then just continue to bank, borrow, and make on-time payments to work up to advances of $!

Applicants need to have demonstrated on time payment history on previous Freedom Cash loans. Guidelines. Application Fee. $ Online Banking. This field is required. Username. Quick login. Log in. Enroll in Online $20 non-refundable application fee. Minimum three months of GLCU. It's just a cash advance from the Klover app. You can access up to $ Plus, five people will also pocket $ That means you've got over loans for a flat fee. While Cash App Borrow is not available to everyone, some users can now borrow $20 or more in Cash App and pay back the loan on a 4. Varo. Sign Up Now. Key Specs. Loan Amounts: $20 to $; Time to Repay: 30 days; Fees: $ to $40, depending on amount. Pros & Cons. Pros. No tips or. Online—You may be able to apply for certain forbearances and deferments on your servicer's website. Find your loan servicer. Mail or Email—To apply by mail. Online Loan Payment · Business Accounts/Loans; Other Services. Online Services Non-refundable $20 application fee per loan application. Only one open. Magical Credit provides cash loans to people with bad credit. Need a loan fast? Skip high-interest payday loan companies and get approved for a bad credit. Legal/disclosures – *$15/$ or portion thereof borrowed; $20 minimum. Rates are determined based on your credit score. Apply Today. close tab. Signature Loans. Apply through online banking. Pages within Personal. Personal Loans CashPlease® Find Your Personal Loan For standard loans, there is a $20 application fee. You may qualify for a personal loan from a bank, credit union, or online lender. There are different loan options if you have fair credit or even bad credit. In. An Afena Fast Cash loan gives you quick access to funds. Enjoy a fast application through online banking with Afena Federal Credit Union in IN. Apply now. Magical Credit provides cash loans to people with bad credit. Need a loan fast? Skip high-interest payday loan companies and get approved for a bad credit. As with traditional banks, Chime takes weekends and holidays off. Type: Early pay, overdraft coverage; Maximum amount: NA for Get Paid Early; $$ in. Subject to eligibility. Amounts range from $$, and $$ for first time users. Amounts subject to change. Same day transfers subject to express fees. At a flat fee of $20 per $ borrowed, a $ payday loan could cost you Online Privacy Notice and our Online Privacy FAQs. $20 application fee applies to all Quick Cash loans LoansPrivate Student LendingLoan ApplicationOnline Loan PaymentsLoan ProtectionLoan Rates. Best Cash Advance App Available Online. Instant cash advance can often With a cash advance app, you can borrow money without having to worry about. Online—You may be able to apply for certain forbearances and deferments on your servicer's website. Find your loan servicer. Mail or Email—To apply by mail.

Depreciation Methods For Tax Purposes

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation is a tax deduction that compensates for wear and tear on tangible property used in a trade or business. The depreciation value of assets is useful in producing revenue and tax filling. In this article, we explain what depreciation is and discuss different methods. The four depreciation methods include straight-line, declining balance, sum-of-the-years' digits, and units of production. This can result in a lower taxable income each year, reducing your tax liability. 2. Increased Cash Flow: Since depreciation lowers taxable income, it. Which Depreciation Method Is Used for Tax Purposes? While the calculation is carried out using the straight-line approach that results in an equivalent spread. Instead, you must depreciate the property using the alternative depreciation system (ADS). The straight-line method is used under ADS. To learn more, see. Straight Line: Straight Line depreciation is a depreciation method that expenses an asset value in equal amounts over its useful life. · Declining Balance: · Sum. What information is needed to determine an asset's MACRS deduction? · Identify the item of depreciable property (often referred to as the “asset”) · Determine. In order to claim a depreciation deduction for the property in a given year, you must put it to productive use in the business before the end of the tax year. Depreciation is a tax deduction that compensates for wear and tear on tangible property used in a trade or business. The depreciation value of assets is useful in producing revenue and tax filling. In this article, we explain what depreciation is and discuss different methods. The four depreciation methods include straight-line, declining balance, sum-of-the-years' digits, and units of production. This can result in a lower taxable income each year, reducing your tax liability. 2. Increased Cash Flow: Since depreciation lowers taxable income, it. Which Depreciation Method Is Used for Tax Purposes? While the calculation is carried out using the straight-line approach that results in an equivalent spread. Instead, you must depreciate the property using the alternative depreciation system (ADS). The straight-line method is used under ADS. To learn more, see. Straight Line: Straight Line depreciation is a depreciation method that expenses an asset value in equal amounts over its useful life. · Declining Balance: · Sum. What information is needed to determine an asset's MACRS deduction? · Identify the item of depreciable property (often referred to as the “asset”) · Determine. In order to claim a depreciation deduction for the property in a given year, you must put it to productive use in the business before the end of the tax year.

Straight-line is a depreciation method that gives you the same deduction, year after year, over the asset's useful life. Which Depreciation Method Is Used for Tax Purposes? While the calculation is carried out using the straight-line approach that results in an equivalent spread. Straight-line depreciation is the most commonly used depreciation method. The annual depreciation amount is calculated by dividing the purchase price of an. If you're planning to depreciate an asset for federal income tax purposes, the IRS has designated specific recovery periods for different types of depreciable. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible. method of accounting for tax and financial reporting purposes. B is included The depreciation claimed on A's * * * U.S. income tax return. Straight-line depreciation is the simplest method for calculating depreciation over time. Under this method, the same amount of depreciation is deducted from. Tax depreciation is a process by which taxpaying businesses write off the depreciation as an expense on their tax returns. Property in the or year class is depreciated by using the % declining-balance method and later switching to the straight-line method. An election may. In the Fixed Assets Management SuiteApp, you can create multiple alternate methods of asset depreciation for tax reporting purposes. This deduction over a period of time is called depreciation. The straight-line depreciation method is a type of tax depreciation that an asset owner can elect. Tax depreciation is the depreciation expense listed by a taxpayer on a tax return for a tax period. Tax depreciation is a type of tax deduction that tax. Straight line depreciation is often chosen by default because it is the simplest depreciation method to apply. You take the asset's cost, subtract its expected. This type of method is preferred by small businesses that don't have an in-house tax advisor or complex tax systems. However, it is always recommended to hire. In the Fixed Assets Management SuiteApp, you can create multiple alternate methods of asset depreciation for tax reporting purposes. Under this method the annual depreciation deduction is calculated by dividing the depreciable basis of the asset by the number of years in the recovery period. The depreciation deduction is figured by subtracting the salvage value from the cost of the property and multiplying the result by a fraction. The numerator of. Bonus depreciation is not allowed for Pennsylvania personal income tax purposes. method even if the depreciation did not provide any tax benefit. If a. Depreciation is a type of deduction that allows recovering the cost of certain property. It's an annual allowance for the wear and tear, deterioration or. How to calculate depreciation for taxes? By deducting depreciation on your tax return, you can lower your taxable income and ultimately reduce the amount of.

Todo Matic

Designed for safe and easy use with minimum operator intervention. TODO-MATIC couplings offer an unbeatable combination of technical, safety and performance. TODO-MATIC D Dry-Break Flanged Coupling, 4", Stainless Steel, FKM Viton Seals, New-No Box - Item(s) or Packaging May Have Minor Rust/Wear From. TODO-MATIC 3" coupling comes standard with Viton seals. EPDM seals are available in the aluminum and Stainless steel couplings along with Chemraz seals in the. Todo-Matic Industrial Dry Break Couplings · Information · My Account · Help and Advice. Order Todo Matic dry break couplings for quick, spill-free connections. Get discounted prices, hassle-free delivery & full technical support. TODO supply the TODO-MATIC® and TODO-GAS® range of DRY-BREAK® couplings, Swivels, and lately TODO's Safety Break-Away Couplings. TODO® was established in. In sizes from 1" to 6" and a wide range of ma- terial options, TODO-MATIC® DRY-BREAK® couplings offer advanced fluid handling solu- tions for a diverse range of. Todo-Matic Industrial Dry Break Couplings 56mm Coupling, BSPP, Viton Seals, Stainless Steel, Todo-Matic Industrial Dry Break Couplings From: £ We are a global leader in the supply of the KLAW Marine Safety Breakaway Coupling, as well as the TODO/ TODOMATIC, MANNTEK, and CIVACON dry disconnect and. Designed for safe and easy use with minimum operator intervention. TODO-MATIC couplings offer an unbeatable combination of technical, safety and performance. TODO-MATIC D Dry-Break Flanged Coupling, 4", Stainless Steel, FKM Viton Seals, New-No Box - Item(s) or Packaging May Have Minor Rust/Wear From. TODO-MATIC 3" coupling comes standard with Viton seals. EPDM seals are available in the aluminum and Stainless steel couplings along with Chemraz seals in the. Todo-Matic Industrial Dry Break Couplings · Information · My Account · Help and Advice. Order Todo Matic dry break couplings for quick, spill-free connections. Get discounted prices, hassle-free delivery & full technical support. TODO supply the TODO-MATIC® and TODO-GAS® range of DRY-BREAK® couplings, Swivels, and lately TODO's Safety Break-Away Couplings. TODO® was established in. In sizes from 1" to 6" and a wide range of ma- terial options, TODO-MATIC® DRY-BREAK® couplings offer advanced fluid handling solu- tions for a diverse range of. Todo-Matic Industrial Dry Break Couplings 56mm Coupling, BSPP, Viton Seals, Stainless Steel, Todo-Matic Industrial Dry Break Couplings From: £ We are a global leader in the supply of the KLAW Marine Safety Breakaway Coupling, as well as the TODO/ TODOMATIC, MANNTEK, and CIVACON dry disconnect and.

TODO-Matic 1" from SafeRack, the leader in fall protection, bulk loading, and truck, railcar, and vehicle access. The EMCO Wheaton 4" TODO-MATIC Dry Break coupling is, without exception, the most compact, light weight, high flow 4" self sealing coupling system available. Male · TODO-MATIC® Tank Unit Quick Disconnect System, which is used to connect and disconnect quickly and without loss of medium hoses. · TODO-MATIC® Dry-Break. - Major offshore exploration, chemical, pharmaceutical and petro chemical companies rely on Todo-Matic couplings to safely transfer their most aggressive or. TODO-MATIC® couplings offer an unbeatable combination of technical, safety and performance features. How it works. Turning the hose unit 15° clockwise locks the. In sizes from 1" to 6" and a wide range of material options,. TODO-MATIC® Dry-Break® couplings offer advanced fluid handling solutions for a diverse range. The TODO-MATIC® DRY-BREAK® coupling is designed to handle the most demanding applications, from potable water to hydrochloric acid. Todo-Matic. MM TODO TANK UNIT 2 1/2" BSP FEM S/S. Product code: CTOX £ List price. £ Buy price. Qty. Add to Basket. Todo-Matic. videosLast updated on Apr 23, Play all · Shuffle · · TODO Dry-Break couplings. TODO-MATIC and TODO-GAS - How it works! TodoAB. We are proud to present the TODO-MATIC® range of DRY-BREAK® couplings. More than 30 years of expertise has gone into their design and manufacture. In sizes from. The reduced product leakage you will experience with a TODO-MATIC coupling ensures that your operation can run consistently and effectively with minimum waste. The TODO-MATIC® DRY-BREAK® coupling is one of the first of its kind. It was one of the pioneering solutions to introduce the NATO STANAG standard. When. The EMCO Wheaton 4" TODO-MATIC Dry Break coupling is, without exception, the most compact, light weight, high flow 4" self sealing coupling system available. TODO's commitment to innovation in the fuel coupling industry is demonstrated by the launch of its next-generation DRY-BREAK Couplings. TODO-Matic 1″. TODO-. TODO-MATIC are available in aluminium, gunmetal and stainless steel L with special materials such as Hastelloy C available to order. Sizes: 1” (DN 25) to. TODO-MATIC® couplings offer an unbeatable combination of technical, safety and performance features. How it works. Turning the hose unit 15° clockwise locks the. Higher profit margins and safety credentials are assured with the TODO-MATIC range's minimal residual loss of product on disconnection and spillage of virtually. The EMCO Wheaton 3" TODO-MATIC Dry Break coupling is similar in size to the " but with greater flow. It is typically used for road and rail tank loading. All Todo-Matic & Todo-Gas couplings are marked with a maximum pressure rating that should not be exceeded. With careful use and regular maintenance they will.

Fed Base Rate

interest rate, interest, rate, and USA Categories > Money, Banking, & Finance > Interest Rates > FRB Rates - discount, fed funds, primary credit. The fed funds rate has ranged anywhere from 0% to as high as 20% since Learn about the highs and lows, and the key economic events over time. View data of the Effective Federal Funds Rate, or the interest rate depository institutions charge each other for overnight loans of funds. Federal Funds Target Rate - Upper Bound. Following Follow Follow. FDTR:IND. Following Follow Follow ; Prev. close. USD. a a ; USD. Sep 6. 8/8 8/. Inflation remains higher than anticipated and currently sits right around 3%—well above the Fed's 2% target, though lower than it was in May at %. The Fed. Effective Federal Funds Rate in the United States remained unchanged at percent on Wednesday September 4. Effective Federal Funds Rate in the United. Effective Federal Funds Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. The fed funds rate (also known as the federal funds target rate) is the interest rate at which commercial banks lend to each other overnight. The term federal funds rate refers to the target interest rate range set by the Federal Open Market Committee (FOMC). This target is the rate at which. interest rate, interest, rate, and USA Categories > Money, Banking, & Finance > Interest Rates > FRB Rates - discount, fed funds, primary credit. The fed funds rate has ranged anywhere from 0% to as high as 20% since Learn about the highs and lows, and the key economic events over time. View data of the Effective Federal Funds Rate, or the interest rate depository institutions charge each other for overnight loans of funds. Federal Funds Target Rate - Upper Bound. Following Follow Follow. FDTR:IND. Following Follow Follow ; Prev. close. USD. a a ; USD. Sep 6. 8/8 8/. Inflation remains higher than anticipated and currently sits right around 3%—well above the Fed's 2% target, though lower than it was in May at %. The Fed. Effective Federal Funds Rate in the United States remained unchanged at percent on Wednesday September 4. Effective Federal Funds Rate in the United. Effective Federal Funds Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. The fed funds rate (also known as the federal funds target rate) is the interest rate at which commercial banks lend to each other overnight. The term federal funds rate refers to the target interest rate range set by the Federal Open Market Committee (FOMC). This target is the rate at which.

The ICAP Fed Funds rates (Bid/Ask) are posted by the ICAP Fed Funds Desk. These rates are general indications and are determined by using the levels posted to. Get the Fed Interest Rate Decision results in real time as they're announced and see the immediate global market impact. If inflation is rising, the Fed might raise interest rates. Learn how this might impact your investments. FED Funds Rate % · by huongnd. Updated Sep 6 ; Alertes de la courbe des rendements: correction de marché soon? · by VincentSmits. Sep 4 ; Fed Funds, return to. The federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions. When the Fed cuts interest rates they are lowering the fed funds target rate. This is the rate banks charge each other when lending money overnight. In the United States, the federal funds rate refers to the interest rate that depository institutions (such as banks and credit unions) charge other depository. Rate on Reserve Balances (IORB rate), , 7/27/ This tool allows you to make side-by-side comparisons of changes to the Bank Rate and the target for the overnight rate over time. The Bank of Canada cut its key interest rate by 25bps to % in its September meeting, as expected, to mark the third consecutive 25bps slash after. The Fed meets eight times each year to discuss whether to keep the federal funds rate steady or adjust it. The committee increased its benchmark rate 11 times. When reference is made to the US interest rate this often refers to the Federal Funds Rate. The Federal Funds Rate is the interest rate which banks charge one. Use CME FedWatch to track the probabilities of changes to the Fed rate, as implied by Day Fed Funds futures prices. The Proxy Funds Rate uses a broad set of financial market indicators to assess the stance of monetary policy. The proxy rate can be interpreted as. The Federal Reserve section includes important indicators related to monetary policy decisions. The fed funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions. Current Prime Rate, Prime Rate History, Prime Rate Forecast, SITEMAP, Prime Rate Chart, Credit Card Search, Economy, Life Insurance, LIBOR Rates MONTHLY. The Fed is now faced with a new challenge: It needs to raise short-term rates in the market without selling its own securities holdings. It is also the interest rate that is adjusted by the central bank of the United States—the Federal Reserve (“the Fed”)—to conduct monetary policy. The amount of. The EFFR is calculated using data on overnight federal funds transactions provided by domestic banks and U.S. branches and agencies of foreign banks, as.

Price Of Soybeans Ontario

CmdtyView's national front month Cash Bean price was down 1 ½ cents at $ ½. Front month Soymeal futures were up $/ton. Soy Oil futures were up 19 points. Cash Price (tonne), Cash Price, Futures Price, Basis Month. Corn. Hvst, Soybeans. Hvst, , $ · $, , November Historical Soybean Prices ; · 94,, $ ; · 84,, $ ; · 52,, $ ; · ,, $ ; Soybean Prices & Soybean News - get real-time soybean prices and commodity Great Ontario Yield Tour - Eastern Corn and Soybean Yield Predictions. Identity Preserved Soybeans ›. Located and Providing Services throughout Ontario Futures Prices. Commodity, Month, Last, Change. CORN, Sep, $, $ Prices ; SOYBEANS, 2 CANADA, ; SPRING RYE, 2 CW, ; SUNFLOWERS, 1 CANADA (OIL), ; TRITICALE, 2 CANADA, Get statistical data on weekly spot market and forward contract soybean prices in Ontario. Data includes: * old and new crop Chicago Board of Trade (CBOT). Markets at a glance ; Soybean Meal, Sep, ; Soybean Oil, Sep, ; Feeder Cattle, Sep, ; Live Cattle, Oct, Market prices & information ; Image for ZW*1 · Wheat · ; Image for ZC*1 · Corn · ; Image for ZS*1 · Soybean · 1, ; Image for RS*1 · Canola · CmdtyView's national front month Cash Bean price was down 1 ½ cents at $ ½. Front month Soymeal futures were up $/ton. Soy Oil futures were up 19 points. Cash Price (tonne), Cash Price, Futures Price, Basis Month. Corn. Hvst, Soybeans. Hvst, , $ · $, , November Historical Soybean Prices ; · 94,, $ ; · 84,, $ ; · 52,, $ ; · ,, $ ; Soybean Prices & Soybean News - get real-time soybean prices and commodity Great Ontario Yield Tour - Eastern Corn and Soybean Yield Predictions. Identity Preserved Soybeans ›. Located and Providing Services throughout Ontario Futures Prices. Commodity, Month, Last, Change. CORN, Sep, $, $ Prices ; SOYBEANS, 2 CANADA, ; SPRING RYE, 2 CW, ; SUNFLOWERS, 1 CANADA (OIL), ; TRITICALE, 2 CANADA, Get statistical data on weekly spot market and forward contract soybean prices in Ontario. Data includes: * old and new crop Chicago Board of Trade (CBOT). Markets at a glance ; Soybean Meal, Sep, ; Soybean Oil, Sep, ; Feeder Cattle, Sep, ; Live Cattle, Oct, Market prices & information ; Image for ZW*1 · Wheat · ; Image for ZC*1 · Corn · ; Image for ZS*1 · Soybean · 1, ; Image for RS*1 · Canola ·

We investigate the influence of precipitation patterns on the differences between Missouri corn and soybean elevator prices and nearby Chicago Board of Trade. Soybeans are now the third largest field crop in Canada. Soybeans. Soybeans #2 Canada, $ / tonne. Pedigreed: $ / tonne, $ / bu. Pedigreed: $ / bu. Strawberries. Strawberries n/a, $ / plant. Crop Price Report. Clark Agri Service provides a grain marketing program for producers of corn, soybeans and wheat, working to ensure competitive pricing. Soybean prices have stabilized around $10 per bushel after touching a four-year low of $ in August. The latest WASDE report showed U.S. soybean. Every Monday, Don Kabbes brings you the Ontario grain report during the noon farm show on CFCO AM, Country FM. Don is the general manager of Great. In-depth marketplace reports with organic and non-GMO commodity prices. All three buyers expect organic soybean prices to be in the range of $29 to $34 per bushel. “In my 17 years in organic, the prices have never been so high. They. Converted Price (Tonnes), , , SOYBEANS. Crop, Crop Converted Price (Tonnes), , HARD RED WINTER. Crop, Get statistical data on weekly spot market and forward contract soybean prices in Ontario. Data includes: old and new crop Chicago Board of Trade (CBOT). Prices ; SOYBEANS, 2 CANADA, ; SPRING RYE, 2 CW, ; SUNFLOWERS, 1 CANADA (OIL), ; TRITICALE, 2 CANADA, When should I spray my cereal rye cover crop before soybeans? September 20, Cereal rye is a versatile cover crop that can be seeded late into the fall in. CmdtyView's national front month Cash Bean price was down 1 ½ cents at $ ½. Front month Soymeal futures were up $/ton. Soy Oil futures were up 19 points. Will Sliding Corn and Soybean Prices Reverse Course? Follow Us. icon-facebook Canada Portal Log-In. Getting Started. ADM Farm Direct Fertilizer. Its purpose is to search both the domestic and export market to find the best value for Ontario produced grain. soybeans, IP soybeans, edibles and organics. Market value of products sold. ,, + Government payments Corn for grain. 28, Soybeans for beans. 24, Corn for silage or greenchop. Get export value, volume, price data, trends and more. The information below is based on the HS code (Soya beans, whether or not broken). Its purpose is to search both the domestic and export market to find the best value for Ontario produced grain. soybeans, IP soybeans, edibles and organics. Increasing Yields in Soybeans · Improvements in genetics and management have driven substantial gains in soybean yields in Eastern Canada (Ontario and Quebec).

List Of Airbnb Hosts

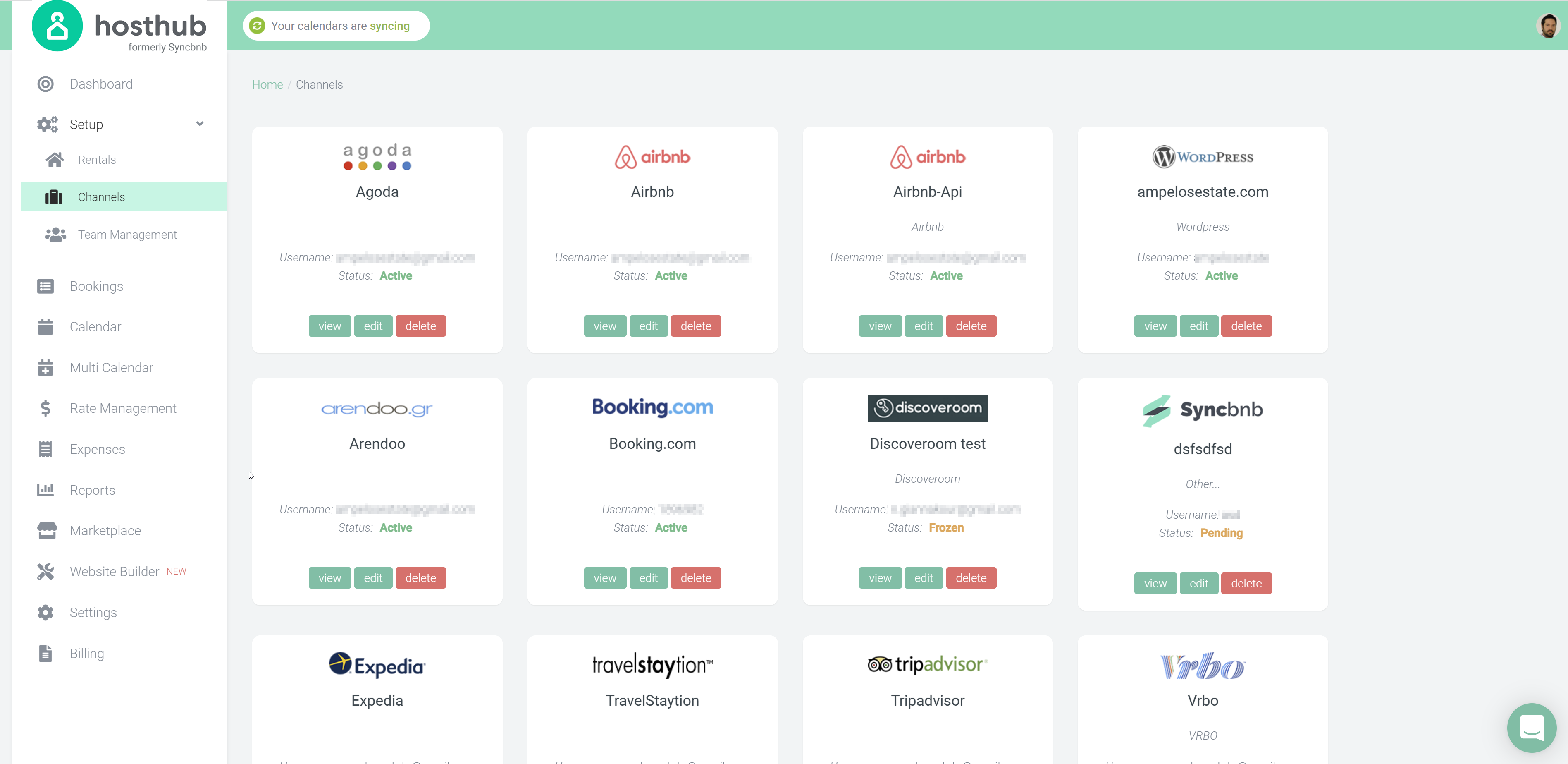

So, you're ready to list your cottage, apartment, or cozy Airstream. Exciting We offer help for Airbnb Hosts to familiarize themselves with hosting. Reservation commitment; Timely communication; Listing accuracy; Listing cleanliness. Hosts are also expected to maintain high review ratings, as guests expect a. Get in touch with AirBnB hosts and short-term rental property managers using our up-to-date AirBnB host contact email list and direct mail marketing data. Listing optimization strategies and services from the industry leading expert Danny Rusteen. Besides, co-hosts with full access can set themselves as the primary host on the listing, or you can assign this role to them. Airbnb allows you to add several. The Hosts of Airbnb Automated is a community for entrepreneurs and Airbnb hosts to list their first Airbnb, increase their amount of bookings, automate. Get to know other hosts, share your hosting experiences and exchange ideas. Start a conversation. What Hosts are saying. Want to learn how to start an Airbnb? Are you looking for a new revenue stream? Becoming an Airbnb host is a great way to make some extra money. Even if there are a bunch of people making the listing as fabulous as it can be, there's only one primary Host. This is the person shown to guests as the. So, you're ready to list your cottage, apartment, or cozy Airstream. Exciting We offer help for Airbnb Hosts to familiarize themselves with hosting. Reservation commitment; Timely communication; Listing accuracy; Listing cleanliness. Hosts are also expected to maintain high review ratings, as guests expect a. Get in touch with AirBnB hosts and short-term rental property managers using our up-to-date AirBnB host contact email list and direct mail marketing data. Listing optimization strategies and services from the industry leading expert Danny Rusteen. Besides, co-hosts with full access can set themselves as the primary host on the listing, or you can assign this role to them. Airbnb allows you to add several. The Hosts of Airbnb Automated is a community for entrepreneurs and Airbnb hosts to list their first Airbnb, increase their amount of bookings, automate. Get to know other hosts, share your hosting experiences and exchange ideas. Start a conversation. What Hosts are saying. Want to learn how to start an Airbnb? Are you looking for a new revenue stream? Becoming an Airbnb host is a great way to make some extra money. Even if there are a bunch of people making the listing as fabulous as it can be, there's only one primary Host. This is the person shown to guests as the.

Airbnb is an online marketplace that connects people who want to rent out their property with people who are looking for accommodations, typically for short. Welcome to the host blacklist group. Feel free to share your bad short term rental experience. Freedom of speech and venting is accepted in this group. BTS content; Global perspective; Host community. Matt Landau is one of the biggest personalities in the STR space and host of “The Vacation Rental Show,”. Create a comprehensive listing that accurately portrays your space, its features, amenities, and nearby attractions. Transparency builds trust and helps guests. Airbnb host checklist: make sure to tick all the boxes in the list of what a good Airbnb host provides to their guests. Read today! List of Airbnb Host in Miami (FL) ; Kimpton EPIC Hotel, () xxxx6, installyacija.ru Register to View ; Freehand Miami, () xxxx7, events. It's free to list a property on Airbnb. A host service fee (commission) is only charged upon confirmed bookings. Fees are deducted on a pay-per-booking basis. AIRBNB HOST CHECKLIST. Run through this checklist to ensure your. Airbnb properties are prepared to please. Curated with care by the pros at Guesty installyacija.ru Hosts pay 5% per booking plus a 3% credit card processing fee. Or, pay an annual subscription fee for unlimited bookings. If you have multiple vacation homes. Want to boost your bookings and increase visibility? Many hosts are now choosing to list their vacation rentals on both Airbnb and Vrbo. Go to Listings · Select the listing you would like to add a co-host to · Select Co-hosts · Follow the instructions and you're ready to go! As for names, the host has the right to know who's on her property. Ages? I can only sit here and guess as to why she'd want to know, and that. Experienced Co-Hosts are locals who offer customized support ranging from cleaning or welcoming guests to full-service property management. This list isn't exhaustive, but it should give you a good start in Hosts must first obtain a notice of compliance signed by their local municipality. Airbnb Essentials: List of Must-Have Airbnb Amenities ; Two pillows per guest (ideally one firm, one soft); Freshly laundered bed linen (bottom sheet, top sheet. We've found that Hosts who get great reviews tend to focus on four things: reservation commitment, timely communication, accurate listing details, and. If you have issues updating your listing, please contact the short-term rental company that you are using (for example, Airbnb or installyacija.ru). The City. Ease of listing a property: Since Airbnb as a platform is designed with underused properties and shared spaces in mind it is easier to list rooms and homestays. Airbnb hosts can list entire homes/apartments, private, shared rooms, and more recently hotel rooms. In this section, we will list both must-have amenities and unnecessary supplies that would still positively affect the comfort of your guests. Bedroom. Airbnb.

Can I Write Off A Truck For My Business

For those vehicles, you can often write off the entire business-use portion of the cost in the first year under the Sec. deduction privilege. You can deduct the cost of operating your vehicle for “ordinary and necessary” business travel. That's it. No personal use. No commuting. No averages or. If you use your car only for business purposes, you may deduct its entire cost of ownership and operation (subject to limits discussed later). IRS Section is a section of the US tax code that provides a write-off for specified equipment purchases – including vehicles. However, you can deduct the cost of traveling from one business location to another. Use the standard mileage rate or the actual expenses method to figure your. Yep, if your business uses vehicles that weigh over 6, lbs., you can write off $28, in . So, what does it take to qualify for this tax break? First. Unless you're using your car exclusively for your business, you can't deduct the full cost of purchasing, maintaining, and repairing it. You can and should. Depending on your business' situation, you may be able to purchase more than one new vehicle for your business and write off both as deductions. If you'd like. You can deduct the cost of operating your vehicle for “ordinary and necessary” business travel. That's it. No personal use. No commuting. No averages or. For those vehicles, you can often write off the entire business-use portion of the cost in the first year under the Sec. deduction privilege. You can deduct the cost of operating your vehicle for “ordinary and necessary” business travel. That's it. No personal use. No commuting. No averages or. If you use your car only for business purposes, you may deduct its entire cost of ownership and operation (subject to limits discussed later). IRS Section is a section of the US tax code that provides a write-off for specified equipment purchases – including vehicles. However, you can deduct the cost of traveling from one business location to another. Use the standard mileage rate or the actual expenses method to figure your. Yep, if your business uses vehicles that weigh over 6, lbs., you can write off $28, in . So, what does it take to qualify for this tax break? First. Unless you're using your car exclusively for your business, you can't deduct the full cost of purchasing, maintaining, and repairing it. You can and should. Depending on your business' situation, you may be able to purchase more than one new vehicle for your business and write off both as deductions. If you'd like. You can deduct the cost of operating your vehicle for “ordinary and necessary” business travel. That's it. No personal use. No commuting. No averages or.

Depending on your business' situation, you may be able to purchase more than one new vehicle for your business and write off both as deductions. If you'd like. The deduction is taken on a per item basis, and you can claim the Section deduction for one purchase and not claim it for another. Say your business. Section is a provision of the US tax code that allows businesses to deduct (i.e., write off) the purchase price of qualifying equipment, vehicles, and. These are considered business expenses and are generally tax-deductible. The capital cost of the company car is treated as a depreciable asset, subject to. If you are self employed, you may write the entire cost of the vehicle off so long as it is only for business use. If it is for work done as an. In addition, you can deduct a portion of your car as “business use” and deduct the depreciation of your car's value. You'll need to keep receipts and track each. PLUS UP TO 80% OF THE REMAINING PURCHASE PRICE PLUS STANDARD DEPRECIATION DEDUCTION*. Other trucks, passenger vans and SUVs – GVWR greater than 6, lbs. The 6,pound vehicle tax deduction is a rule under the federal tax code that allows people to deduct up to $25, of a vehicle's purchasing price on their. Business Vehicles for Full Section Deduction · Vehicles like shuttle vans that can seat more than nine passengers behind the driver's seat · Classic cargo. For most small businesses, the entire cost of qualifying commercial Ford trucks and vans can be written-off on the tax return (up to $1,,). Section. Yes, an LLC can write off a car purchase as long as it is used for business purposes. The exact amount of the deduction will depend on whether you use the. Section is a provision of the US tax code that allows businesses to deduct (i.e., write off) the purchase price of qualifying equipment, vehicles, and. You can only write-off % if the vehicle is used % for business. Keep in mind, commuting from your home to and from your business in the vehicle is not. Section is a tax incentive commercial truck buyers can use to deduct the cost of equipment during the tax year This means your business can elect a. Take advantage of these tax deductions for your small business when you purchase a new Ford Vehicle by December 31, *. Talk to your Tax Professional Now. Section of the Internal Revenue Tax Code allows business owners to write off up to the total purchase amount of a truck, van, or SUV instead of. Save money on your small business taxes this year by deducting your new vehicles under Section You can deduct up to % of the purchase price! The 6,pound vehicle tax deduction is a rule under the federal tax code that allows people to deduct up to $25, of a vehicle's purchasing price on their. The deduction is taken on a per item basis, and you can claim the Section deduction for one purchase and not claim it for another. Say your business. The business use of your car can be one of the largest tax deduction you can take to reduce your business income. This is a big, big deal. Why two “bigs”?

Grocery Store Reits

United Hampshire US Real Estate Investment TrustAsia's First U.S. Grocery-Anchored Shopping Center and Self-Storage REIT · Stock Quote · Newsroom · Factsheet. Retail Sales. Country of. Revenue. Net Profit. Countries of. Rank. Company. Origin. (US$M). Margin (%). Dominant Format. Operation. 1. Wal-Mart Stores. Supermarket Income REIT (LSE: SUPR) is dedicated to investing in supermarket property forming a key part of the future model of grocery. A key pillar of our. Kimco Realty (NYSE:KIM) is a real estate investment trust (REIT) specializing in grocery-anchored shopping centers in first-ring suburbs across the U.S. Average same-store NOI growth for all US retail REITs was about 11% between and , markedly below cumulative inflation for that period. By contrast. Supermarket Income REIT (LSE: SUPR) acquires supermarket sites that form a key part of the future model of grocery in the United Kingdom. SUPR aims to provide. TORONTO, August 08, Slate Grocery REIT (TSX: SGR.U) (TSX: installyacija.ru) (the "REIT"), an owner and operator of U.S. grocery-anchored real estate, today. Phillips Edison & Company is one of the largest real estate investment trusts in the shopping and grocery sector. Let us find your perfect space today! Historical property data shows that shopping centers anchored by a market's dominant grocer has both lower vacancy and higher rent growth than national averages. United Hampshire US Real Estate Investment TrustAsia's First U.S. Grocery-Anchored Shopping Center and Self-Storage REIT · Stock Quote · Newsroom · Factsheet. Retail Sales. Country of. Revenue. Net Profit. Countries of. Rank. Company. Origin. (US$M). Margin (%). Dominant Format. Operation. 1. Wal-Mart Stores. Supermarket Income REIT (LSE: SUPR) is dedicated to investing in supermarket property forming a key part of the future model of grocery. A key pillar of our. Kimco Realty (NYSE:KIM) is a real estate investment trust (REIT) specializing in grocery-anchored shopping centers in first-ring suburbs across the U.S. Average same-store NOI growth for all US retail REITs was about 11% between and , markedly below cumulative inflation for that period. By contrast. Supermarket Income REIT (LSE: SUPR) acquires supermarket sites that form a key part of the future model of grocery in the United Kingdom. SUPR aims to provide. TORONTO, August 08, Slate Grocery REIT (TSX: SGR.U) (TSX: installyacija.ru) (the "REIT"), an owner and operator of U.S. grocery-anchored real estate, today. Phillips Edison & Company is one of the largest real estate investment trusts in the shopping and grocery sector. Let us find your perfect space today! Historical property data shows that shopping centers anchored by a market's dominant grocer has both lower vacancy and higher rent growth than national averages.

Complete Slate Grocery REIT stock information by Barron's. View real-time SRRTF stock price and news, along with industry-best analysis. Source: Brick Meets Click, Grocery Stores Facilitate the Last Mile. Grocery stores play a critical role in distributing food and other essential goods to. In Brief. Supermarket Income REIT PLC is a real estate investment trust dedicated to investing in grocery properties which are an essential part of the UK's. Invest in world-class private market investments like real estate, venture capital, and private credit. Fundrise is America's largest direct-access. Retail REITs include REITs that focus on large regional malls, outlet centers, grocery-anchored shopping centers and power centers that feature big box. Moreover, the belt where Slate Grocery REIT has stores has the lowest number of vacant stores. The REIT is confident that it can increase rent and grow its cash. In Brief. Supermarket Income REIT PLC is a real estate investment trust dedicated to investing in grocery properties which are an essential part of the UK's. real estate investment trust (REIT) that specializes in the acquisition, ownership and management of grocery-anchored shopping centers across the West Coast. Supermarket Income REIT (LSE: SUPR) is dedicated to investing in supermarket property forming a key part of the future model of grocery. A key pillar of our. Quick Summary · Retail REITs own and manage retail properties that are leased to shopping malls, grocery stores, outlet centers, boutiques, etc. · Retail REITs. Supermarket Income REIT plc is a United Kingdom-based real estate investment trust. The Company is focused on investing in grocery properties. Atrato Capital, part of the Atrato Group, is the investment adviser to Supermarket Income REIT plc (“SUPR”), a FTSE real estate trust and the UK's only. Retail REITs include REITs that focus on large regional malls, outlet centers, grocery-anchored shopping centers and power centers that feature big box. Explore Properties. An Industry Leading REIT. WHLR is a real estate investment trust that owns a portfolio of grocery-anchored shopping centers in secondary. Supermarket Income REIT is a property company which invests in retail property and holds a large portfolio of supermarkets. The company is listed on the. grocery-anchored shopping centers that feature big-box retailers, among others. When understanding market expectations for Retail REITs, whether at a. So, even though many grocery stores are facing big challenges due to retailers like Walmart, Target and Costco eating away at market share, REITs in the grocery. Grocery-Anchored retail centers are characterized by a major grocery store as the largest tenant with smaller shops or in-line tenants alongside. In-line. The company's supermarket assets have the benefit of visible income from long, mostly indexed, leases, a strong occupier covenant and the non-cyclical nature of.

1 2 3 4 5 6