installyacija.ru Recently Added

Recently Added

Loan And Credit Card Consolidation

We offer a large Debt Consolidation Loan with low interest to pay off small debts, such as credit cards or student loans and other numerous debts. Debt consolidation is when you combine multiple debts into one personal loan. Here's an example: If you owe $6, in credit card debt and $4, in medical. Debt consolidation is when you roll some or all of your debts, or multiple debts, into a single monthly payment. Should you consolidate your debt? Fill in loan amounts, credit card balances, and other debt to see what your monthly payment could be with a consolidated loan. In the prime risk tier, debt consolidation loans had a serious delinquency rate (defined as 60+DPD for this product) of % compared to % for loans used for. Simplify your bills with a debt consolidation loan · Check your rate in 5 minutes. · Get funded in as fast as 1 business day.² · Consolidate your bills into 1. Debt consolidation is when someone takes out a loan and uses it to pay off other loans—often high-interest debt like credit cards and car loans. You try to find. High credit scores mean you'll be more likely to qualify for a loan with favorable terms for debt consolidation. Generally, borrowers with scores of or. Debt consolidation is a way to pay off multiple unpaid balances by combining them into one lower-interest loan or line of credit for faster repayment. We offer a large Debt Consolidation Loan with low interest to pay off small debts, such as credit cards or student loans and other numerous debts. Debt consolidation is when you combine multiple debts into one personal loan. Here's an example: If you owe $6, in credit card debt and $4, in medical. Debt consolidation is when you roll some or all of your debts, or multiple debts, into a single monthly payment. Should you consolidate your debt? Fill in loan amounts, credit card balances, and other debt to see what your monthly payment could be with a consolidated loan. In the prime risk tier, debt consolidation loans had a serious delinquency rate (defined as 60+DPD for this product) of % compared to % for loans used for. Simplify your bills with a debt consolidation loan · Check your rate in 5 minutes. · Get funded in as fast as 1 business day.² · Consolidate your bills into 1. Debt consolidation is when someone takes out a loan and uses it to pay off other loans—often high-interest debt like credit cards and car loans. You try to find. High credit scores mean you'll be more likely to qualify for a loan with favorable terms for debt consolidation. Generally, borrowers with scores of or. Debt consolidation is a way to pay off multiple unpaid balances by combining them into one lower-interest loan or line of credit for faster repayment.

Truliant debt consolidation loans help members combine debt into a single loan and pay off others loans. This helps them to concentrate on paying down debt with. A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. A Rocket Loans℠ debt consolidation loan allows you to combine multiple debts - like credit cards or other loans - into one single, easy to manage payment. When you click “Check Your Rate,” PenFed does a soft credit pull to check the financing you're eligible for — that does not affect your credit score. Once you. When you consolidate your credit card debt with a personal loan, your credit card balance will be cleared and you can focus on repaying the loan instead. Consolidate your credit card debt with ease. Check your rate in 5 minutes. Get funded in as fast as 1 business day. Annual Percentage Rates (APRs) range from %–%. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination. Credit card consolidation can save you money on interest if you're able to qualify for a lower interest rate. This could help you get out of debt faster, as. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come. Pay off your high-interest credit card debt with a personal loan from PNC. Borrow up to $35K with no collateral required. See current rates and apply today. Estimate what you owe today on your loans, credit cards and lines of credit with the TD Debt Consolidation Calculator. Then, find out when you could be debt. A credit card consolidation loan lets you roll multiple high-interest credit card debts into a single loan with a fixed rate, term and one monthly payment. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. On the other hand, unsecured loans can also be used to consolidate debts, such as personal loans or balance-transfer credit cards. They tend to have higher. Debt Consolidation: Debt consolidation combines multiple debts into a new loan with a single monthly payment. You may be able to obtain a lower rate, lower. A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates. Your credit score may drop slightly directly after you consolidate debt. Over time, however, a responsible financial approach toward debt consolidation can. We've rounded up our picks for the best debt consolidation loans, so keep reading to see which loan might be the best option for you. LightStream: Best for high-dollar loans and longer repayment terms. LightStream · ; Upstart: Best for little credit history. Upstart ·

First Majestic Mint

The reverse showcases the First Majestic logo in a diagonal pattern, along with the ticker symbol and the name of the private mint that produced the bar. Northwest Territorial Mint. Fine Weight 1 troy oz ( gram). Diameter 39 mm. Thickness mm. Tax Status Gross Margin Scheme. Product Information. Produced. First Majestic Silver Corp. is proud to be the only mining company offering their own production in the form of silver bullion for sale securely online 24/7. AG just launched their own mint called First Mint that only sells bars for now. The bars look pretty clean and the per oz price is cheaper than. Located in the State of Nevada, USA, First Mint produces world class silver bullion. Our raw material comes from mine sites in Mexico. Direct from the Royal Canadian Mint: Premium Bullion puts the purest precious metals in your hands. Welcome First Majestic is a mining company focused on silver production in Mexico and is aggressively pursuing the development of its existing mineral. First Majestic Silver Corp. is a beacon of purity and reliability in the silver bullion market. It offers a selection of fine silver rounds, ingots, bars. First Majestic Silver launches “First Mint” in Nevada First Majestic Silver Corp. [FR-TSX, AG-NYSE, FMV-Frankfurt] on Tuesday announced the completed. The reverse showcases the First Majestic logo in a diagonal pattern, along with the ticker symbol and the name of the private mint that produced the bar. Northwest Territorial Mint. Fine Weight 1 troy oz ( gram). Diameter 39 mm. Thickness mm. Tax Status Gross Margin Scheme. Product Information. Produced. First Majestic Silver Corp. is proud to be the only mining company offering their own production in the form of silver bullion for sale securely online 24/7. AG just launched their own mint called First Mint that only sells bars for now. The bars look pretty clean and the per oz price is cheaper than. Located in the State of Nevada, USA, First Mint produces world class silver bullion. Our raw material comes from mine sites in Mexico. Direct from the Royal Canadian Mint: Premium Bullion puts the purest precious metals in your hands. Welcome First Majestic is a mining company focused on silver production in Mexico and is aggressively pursuing the development of its existing mineral. First Majestic Silver Corp. is a beacon of purity and reliability in the silver bullion market. It offers a selection of fine silver rounds, ingots, bars. First Majestic Silver launches “First Mint” in Nevada First Majestic Silver Corp. [FR-TSX, AG-NYSE, FMV-Frankfurt] on Tuesday announced the completed.

First Majestic starts selling bullion at Nevada mint facility. Article by installyacija.ru Read the full article here: installyacija.ru Back in stock! Tsuki 'Sakura Mint' A6 Travel Notebook ☾. First Majestic Silver Corp. is proud to be the only mining company offering their own production in the form of silver bullion for sale securely online 24/7. First Majestic starts selling bullion at Nevada mint facility. Article by @mining Read the full article here: installyacija.ru Located in the State of Nevada, United States, First Mint vertically integrates a manufacturing plant for investment-grade fine silver bullion into the First. First Majestic Silver Corp. is proud to be the only mining company offering their own production in the form of silver bullion for sale securely online 24/7. 1 oz Silver First Majestic Coin (random years). SKU oz Silver Asahi Mint Bar As low as $4, · Add to cart. New. Contact. minting facility, First Mint, LLC ("First Mint"). Situated in Nevada, United States, First Mint represents a significant addition to First Majestic's. First Majestic Silver Corp. | followers on LinkedIn. There's no substitute for silver | First Majestic is a publicly traded mining company focused on. First Majestic portfolio. In line with First Majestic's commitment to environmental and community stewardship, First Mint operates state-of-the-art machines. 27 likes, 3 comments - firstmajesticsilver on January 23, "Our %-owned and operated minting facility, First Mint LLC, is currently in the. Located in the State of Nevada, USA, First Mint produces world class silver bullion. Our raw material comes from mine sites in Mexico, which are owned and. First Majestic is a #mining company focused on #silver production in Mexico, as well as #gold development mint. Quote. Kevin Bambrough · @BambroughKevin. ·. These 1 ounce silver rounds are unique in that they are sold by the same company that mined and refined the silver. All of First Majestic's silver is mined. Mints: Scottsdale Mint Scottsdale Mint · Mints: Royal Canadian Mint Royal My first order. The payment cleared quickly. The order was shipped on the. First Majestic mines and refines all of their own silver, and then send it to one of three private mints to have the final round produced. Buy the 1 oz First. - First Majestic operates all its silver mines in Mexico. - The company mines and refines its silver in-house before sending it to one of three private mints. Find many great new & used options and get the best deals for Silver Bar 10 oz (First Majestic Silver) Bullion Silver. Mint Condition at the best. Insights. Expansion into NevadaFirst Majestic Silver Corp has recently expanded its facilities to Nevada, United States, and started selling bullion at a mint. For , First Majestic is also slated to launch its % owned and operated mint, First Mint, LLC to manufacture its very own exceptional silver bullion.

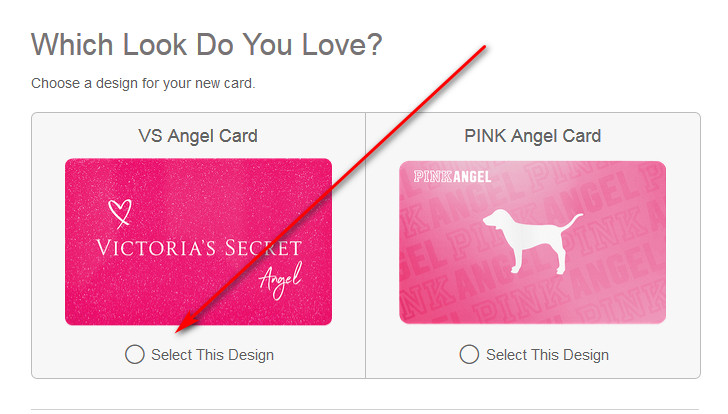

Victoriassecret Com Credit Card

To make a payment on your Victoria's Secret or Victoria's Secret Mastercard Credit Card, use Comenity's Easy Pay, issuer for The Victoria's Secret Credit Card. In this review we're covering the Victoria's Secret Angel Card in terms of its benefits, rewards program, fees, drawbacks, & more so read on to find out if. Victoria's Secret Mastercard® or Victoria's Secret Credit Card Account Website. Select to be redirected · Home · Activate Card · EasyPay. Victoria's Secret offers customers the option to shop using the Comenity Bank Angel credit card. Unlike a Visa or Amex card, this is a store card and can be. Get rewarded when you spend at Victoria's Secret and enjoy exclusive member benefits with our store credit card. Apply instantly online to get started. Overall, Victoria Secret credit card is strongly not recommended based on community reviews that rate customer service and user experience. Order Status · Store Locator · LOGOUT · The VS Credit Card · Gift Cards · Our Brands · Victoria's Secret · PINK. 5 FREE PANTIES when you buy 3 or more. Details. Find many great new & used options and get the best deals for VICTORIA'S SECRET ANGEL Credit Card ~ EVERY COLLECTOR NEEDS ONE! LQQK! at the best online. You need a credit score of + to get the Victoria's Secret Credit Card; this means at least fair credit is required for approval. To make a payment on your Victoria's Secret or Victoria's Secret Mastercard Credit Card, use Comenity's Easy Pay, issuer for The Victoria's Secret Credit Card. In this review we're covering the Victoria's Secret Angel Card in terms of its benefits, rewards program, fees, drawbacks, & more so read on to find out if. Victoria's Secret Mastercard® or Victoria's Secret Credit Card Account Website. Select to be redirected · Home · Activate Card · EasyPay. Victoria's Secret offers customers the option to shop using the Comenity Bank Angel credit card. Unlike a Visa or Amex card, this is a store card and can be. Get rewarded when you spend at Victoria's Secret and enjoy exclusive member benefits with our store credit card. Apply instantly online to get started. Overall, Victoria Secret credit card is strongly not recommended based on community reviews that rate customer service and user experience. Order Status · Store Locator · LOGOUT · The VS Credit Card · Gift Cards · Our Brands · Victoria's Secret · PINK. 5 FREE PANTIES when you buy 3 or more. Details. Find many great new & used options and get the best deals for VICTORIA'S SECRET ANGEL Credit Card ~ EVERY COLLECTOR NEEDS ONE! LQQK! at the best online. You need a credit score of + to get the Victoria's Secret Credit Card; this means at least fair credit is required for approval.

The Victoria's Secret Credit Card now allows cardmembers to make contactless mobile payments using Apple Pay, while also providing one of the most secure and. Your Victoria's Secret Credit Card account agreement. This Agreement covers the Terms and Conditions of your account with us. In this document, you will. Aug 25, - Find great deals up to 70% off on pre-owned Victoria's Secret Credit Card Wallets for Women on Mercari. Save on a huge selection of new and. BASeymour Please contact our Credit Card Customer Care at () (Comenity Bank) Mon-Sat 8am-9pm EST. When calling, choose your. Victoria's Secret Angel Credit Card. BENEFITS. MANAGE ACCOUNT. The Angel Card: Angel Cardholders: Pay your bill. View your statement. Check. The Victoria's Secret Credit Card Program. Manage your Victoria's Secret Mastercard® or Victoria's Secret Credit Card. More Details. When you call, be sure to have your credit card number and personal information on hand to verify your installyacija.ru issuer may have closed your account due to. Pay your Victorias Secret Credit Card (Comenity) bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the. The Victoria's Secret credit card is a basic store-branded card, which can only be used at all Victoria's Secret and PINK stores and at installyacija.ru When you call, be sure to have your credit card number and personal information on hand to verify your installyacija.ru issuer may have closed your account due to. The Victoria's Secret Credit Card could be a great choice if you're a loyal Victoria's Secret shopper who tends to spend more than $ in-store per year. Need to find a gift for her? Consider giving a Victoria's Secret PINK eGift Card at eGifter today! How to buy Victoria's Secret eGift Cards · Go to installyacija.ru or type Victoria's Secret eGift Card into the search bar. Fintable integrates with Victoria's Secret Credit Card APIs via FINICITY to sync your bank transactions and account balances to Airtable. Welcome to the Victoria's Secret App: Your go-to destination for discovering new trends, exclusive offers, the latest and greatest shopping and styling. Get all the details of Victoria's Secret Credit Card including APR, annual fee, reward points, so you can apply for the right card today. Victoria's Secret offers customers the option to shop using the Comenity Bank Angel credit card. Unlike a Visa or Amex card, this is a store card and can be. The Victoria's Secret credit card is a basic store-branded card, which can only be used at all Victoria's Secret and PINK stores and at installyacija.ru Credit Card. Description. Credit Cards/Accounts. Home App URL. installyacija.ru Logon App URL. installyacija.ru Class. Loans are made or arranged pursuant to California Financing Law license 60DBO The Affirm Card is a Visa® debit card issued by Evolve Bank & Trust.

What Are The Taxes On Short Term Capital Gains

Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on. While the federal long-term capital gains tax applies to all states, there are eight states that do not assess a long-term capital gains tax. They are. Short-term capital gains are taxed as ordinary income. Any income that you receive from investments that you held for one year or less must be included in your. Long-term capital gains are subject to lower rates of tax than short-term capital gains, which are taxed at ordinary income tax rates. You therefore need to. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Short-term capital gains taxes apply to profits from selling assets held for a year or less, while long-term capital gains taxes apply to profits from selling. They are subject to ordinary income tax rates meaning they're taxed federally at either 10%, 12%, 22%, 24%, 32%, 35%, or 37%. Short-term capital gains are taxed at the same rate as your ordinary income. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is. Short-term capital gains are gains on investments you owned 1 year or less and are taxed at your ordinary income tax rate. How are capital gains reported? Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on. While the federal long-term capital gains tax applies to all states, there are eight states that do not assess a long-term capital gains tax. They are. Short-term capital gains are taxed as ordinary income. Any income that you receive from investments that you held for one year or less must be included in your. Long-term capital gains are subject to lower rates of tax than short-term capital gains, which are taxed at ordinary income tax rates. You therefore need to. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Short-term capital gains taxes apply to profits from selling assets held for a year or less, while long-term capital gains taxes apply to profits from selling. They are subject to ordinary income tax rates meaning they're taxed federally at either 10%, 12%, 22%, 24%, 32%, 35%, or 37%. Short-term capital gains are taxed at the same rate as your ordinary income. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is. Short-term capital gains are gains on investments you owned 1 year or less and are taxed at your ordinary income tax rate. How are capital gains reported?

The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's. Do I have to file a tax return if I don't owe capital gains tax? No. You are not required to file a capital gains tax return if your net long-term capital. Other sold assets will be taxed at long-term capital gains rates. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each. Capital Gains are derived from the sale of capital assets. There are two kinds of capital gains: short-term and long-term. A short-term capital gain is from the. Short-term capital gains are gains you make from selling assets held for one year or less. They're taxed like regular income. That means you pay the same tax. Your profit when you sell a stock, house or other capital asset. If you owned the asset for more than a year, the gain is considered long-term, and special tax. Long term gains are taxed based on income as well, but with generally more favorable rates. All EquityMultiple investments are held for longer than one year, so. Short-term gains come from the sale of assets you have owned for one year or less. They are typically taxed at ordinary income tax rates, as high as 37% in Short-term capital gains are profits from selling assets you own for a year or less. They're usually taxed at ordinary income tax rates (10%, 12%, 22%, 24%, 32%. Long-term capital gains tax rates are 0%, 15%, or 20%, depending on your taxable income and filing status. Yes, this means that you can pay as little as 0% in. Short-term capital gains are for assets held for one year or less. They are taxed at the same rates as ordinary income. As a result, depending on your taxable. Long-term capital gain: 10 (on sale of equity shares/ units of equity oriented funds/units of business trust in excess of INR , and security transaction. The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing status. The difference between short-term and long-term capital gains lies in the tax rate investors must pay. Short-term capital gains are taxed at % while long-. Income Tax Return. Capital gains and losses are classified as long-term or short term. If you hold the asset for more than one year, your capital gain or. Short-term capital gains include the profits on any assets sold one year or less from the original purchase date. Long-term capital gains include the profits of. Just like income tax, you'll pay a tiered tax rate on your capital gains. For example, a single person with a total short-term capital gain of $15, would pay. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double. What is capital gains income? What are short- and long-term capital gains? When a taxpayer sells a capital asset, such as stocks, a home, or business assets.

2 3 4 5 6