installyacija.ru Tools

Tools

How To Buy Stocks On The Weekend

Hi, You cannot buy stocks on weekend but you can place your buy order for next stock market working day. It is called AMO - Advanced Market. Interactive Broker clients can trade over 10, U.S. stocks and ETFs from 8pm ET to am ET Sunday to Friday using the IBKR Overnight destination. In the United States, Fridays on the eve of three-day weekends tend to be especially good. Due to generally positive feelings before a long holiday weekend, the. The After Hours session and the After Hours Trade Stock Orders screen are only available from 4 to 8 p.m. Eastern Time, Monday through Friday excluding market. Yes, traders can buy stocks over the weekend using Electronic Communication Networks (ECNs). These networks allow trading during pre and post-market hours, and. Simply log into your online brokerage account and select the stock, or stocks, that you wish to trade. The key difference is that instead of placing a market. Potential reasons to trade during the weekend There are additional risks to extended-hours trading. Check out Risk factors to consider for more details. But when news breaks outside of trading hours, an imbalance between buy and sell orders may cause a stock to open dramatically higher or lower than its price at. You can't trade stocks on the weekend anywhere unfortunately, because exchanges are closed. However, you can trade virtual futures of the stocks. Hi, You cannot buy stocks on weekend but you can place your buy order for next stock market working day. It is called AMO - Advanced Market. Interactive Broker clients can trade over 10, U.S. stocks and ETFs from 8pm ET to am ET Sunday to Friday using the IBKR Overnight destination. In the United States, Fridays on the eve of three-day weekends tend to be especially good. Due to generally positive feelings before a long holiday weekend, the. The After Hours session and the After Hours Trade Stock Orders screen are only available from 4 to 8 p.m. Eastern Time, Monday through Friday excluding market. Yes, traders can buy stocks over the weekend using Electronic Communication Networks (ECNs). These networks allow trading during pre and post-market hours, and. Simply log into your online brokerage account and select the stock, or stocks, that you wish to trade. The key difference is that instead of placing a market. Potential reasons to trade during the weekend There are additional risks to extended-hours trading. Check out Risk factors to consider for more details. But when news breaks outside of trading hours, an imbalance between buy and sell orders may cause a stock to open dramatically higher or lower than its price at. You can't trade stocks on the weekend anywhere unfortunately, because exchanges are closed. However, you can trade virtual futures of the stocks.

Market: Choose this type to buy or sell a security such as a stock that will be executed immediately at the best price currently available on the market. Market. Post-market hours are from 4 pm to 8 pm ET. To trade U.S. stocks and ETFs during extended market hours, the following conditions apply: The order must be. Investors can buy and sell shares in commodity ETFs during regular trading hours. When does the market open on the weekends? There are no regular trading hours. The weekend is a good time to make up your mind on what stocks you want to buy or sell. Since the market is closed, you won't be affected by price fluctuations. Schwab offers extended hours trading sessions before and after regular market hours of am - 4 pm ET. Additionally, 24/5 trading of select securities is. Potential reasons to trade during the weekend There are additional risks to extended-hours trading. Check out Risk factors to consider for more details. The regular schedule for the New York Stock Exchange and Nasdaq is Monday through Friday from am to 4 pm Eastern time with weekends off. After-hours trading takes place after the trading day for a stock exchange. It allows you to buy or sell stocks outside of normal trading hours. Most stock exchanges operate Monday to Friday, however, Middle Eastern stock exchanges tend to run Sunday to Thursday, as Friday and Saturday are weekend days. Since the stock market is not open on Saturday and Sunday, they are not included in this rolling period. The next day on which a day trade could be made is. Post-market hours are from 4 pm to 8 pm ET. To trade U.S. stocks and ETFs during extended market hours, the following conditions apply: The order must be. However, during any given extended hours session, certain securities may not trade due to a lack of trading interest. The overnight trading session in. To buy stocks after hours, you will need a brokerage platform that allows you to participate in the premarket or after-hours trading sessions. Futu makes this. Weekend Roundup ; Beyond Nvidia, these companies are making money from AI · NVDA % ; Commercial-real-estate risk for banks points to opportunities for other. Trade US Stocks and ETFs, Options and Bonds Around the Clock · Capture More Market Opportunities · Overnight Trading on US Stock and ETFs · Trade More US Stocks/. Investors who want to trade stocks on the weekends will find that they have a few different options available to you. Your first option is to simply place. How to open your out-of-hours trade · Login or create your CFD trading account · CFD trading · Select a market · Extended share trading hours · Weekend trading. Most stock exchanges will offer pre- and post-market trading, Monday to Friday. These sessions don't work in the same way as the regular hours, as buyers and. After-hours trading refers to the period of time after the market closes and during which an investor can place an order to buy or sell stocks or ETFs. You simply log into your brokerage account and place orders for the stocks you want to buy. It then goes through the ECN, matching your price to the shares of.

How Much Do You Have To Pay To Give Birth

Do they give you citizenship if you give birth in Canada? What is After uploading the documents, you will also need to pay the state fee for their review. Prenatal Health Coverage: Overview. Having a baby can be very expensive. The estimated average cost of the labor and delivery of an uncomplicated birth in. You may be surprised to learn that there's a huge range depending on where you live, how you give birth and whether you have insurance or not. Labor and. Based on the actual birth cost · The father's monthly income is $2, · The income for 36 months is $72, · 5% of the father's income over 36 months is $3, On MDsave, the cost of a Vaginal Delivery in Texas, ranges from $5, to $9, What is MDsave, and who can use MDsave? MDsave is an online healthcare. For newborns, the cost can be even higher. When you factor in healthcare (including birth), some estimates point to spending anywhere from $9, to $23, per. If you are not a citizen or do not have PR, the cost for an uncomplicated birth is $15, to $20, depending on the hospital. If there are. Will you need a midwife or doula? How do you create a backup plan? Find Who do you want to be with you when you give birth? What do you want your. How much does having a baby cost in the US with or without insurance? · (No insurance) Total average hospital bill for a regular birth: $30, · (No insurance). Do they give you citizenship if you give birth in Canada? What is After uploading the documents, you will also need to pay the state fee for their review. Prenatal Health Coverage: Overview. Having a baby can be very expensive. The estimated average cost of the labor and delivery of an uncomplicated birth in. You may be surprised to learn that there's a huge range depending on where you live, how you give birth and whether you have insurance or not. Labor and. Based on the actual birth cost · The father's monthly income is $2, · The income for 36 months is $72, · 5% of the father's income over 36 months is $3, On MDsave, the cost of a Vaginal Delivery in Texas, ranges from $5, to $9, What is MDsave, and who can use MDsave? MDsave is an online healthcare. For newborns, the cost can be even higher. When you factor in healthcare (including birth), some estimates point to spending anywhere from $9, to $23, per. If you are not a citizen or do not have PR, the cost for an uncomplicated birth is $15, to $20, depending on the hospital. If there are. Will you need a midwife or doula? How do you create a backup plan? Find Who do you want to be with you when you give birth? What do you want your. How much does having a baby cost in the US with or without insurance? · (No insurance) Total average hospital bill for a regular birth: $30, · (No insurance).

Medicaid payments for all maternal and newborn care were $ for vaginal birth and $13, for cesarean birth. The authors noted that both commercial and. Preparing for a new baby is exciting, but handling hospital delivery costs can be overwhelming. Learn about common maternity billing expenses you can. An additional monitoring fee of $ per day is applicable for mothers requiring extra attention, while a fee of $1, per day is assessed for babies in need. These two programs give pregnant women the care they need to keep their babies healthy. You can apply for both programs at the same time. If you are eligible. How much are the deposits? Labour and childbirth deposit is $10, Will my total fees be more than the deposit? This depends on the care you need. – Midwife fee which is usually between dollars. This fee covers prenatal care, birth, postpartum check up, newborn check up and screening. – Lab test. On average, new mums spend three nights in hospital. If you choose to have your baby at home, then you obviously won't need to pay for hospital accommodation. You should have international medical insurance if you don't want to pay the costs out-of-pocket. Birth tourism is popular in Canada because it's one of the few. Typically cost can range anywhere from $8, on the low end for a natural birth of up to $40, in total for a hospital birth, depending on the situation. But here are some ballpark figures: Prenatal care and delivery costs can range from about $9, to over $, (quite a range, huh?). But before you freak. For tourists and non-residents, there will be a fee for having a baby in Canada. For example, a natural birth in a hospital could cost $$, and a C-. Some of these costs maybe covered by insurance, but you might still need to pay for some things yourself. On average, the costs of childbirth in North Carolina. Health coverage if you're pregnant, plan to get pregnant, or recently gave birth. All Marketplace and Medicaid plans cover pregnancy and childbirth. This is. The hospital, doctors, labs and anyone else will simply mail you their bills and expect payment. In many cases, you can call the healthcare. The average cost to have a baby in the United States is nearly $11,, underscoring the fact that babies may be small, but they are not inexpensive. If you. In most cases, yes – insurance will help cover childbirth. However, to what extent really depends on the kind of coverage you have. Maternity Package Pricing $* · Care with a Utah-licensed, direct-entry midwife and midwife assistant (MW Assist's fee included) · Client goodie bag with. My wife and I had a pretty “normal” delivery of our first child in the hospital and the bill was around $25, Fortunately we had good medical. Only Kaiser Permanente members can use this secure feature, and you'll need to be registered on installyacija.ru Members: Get an estimate of how much you'll pay to have.

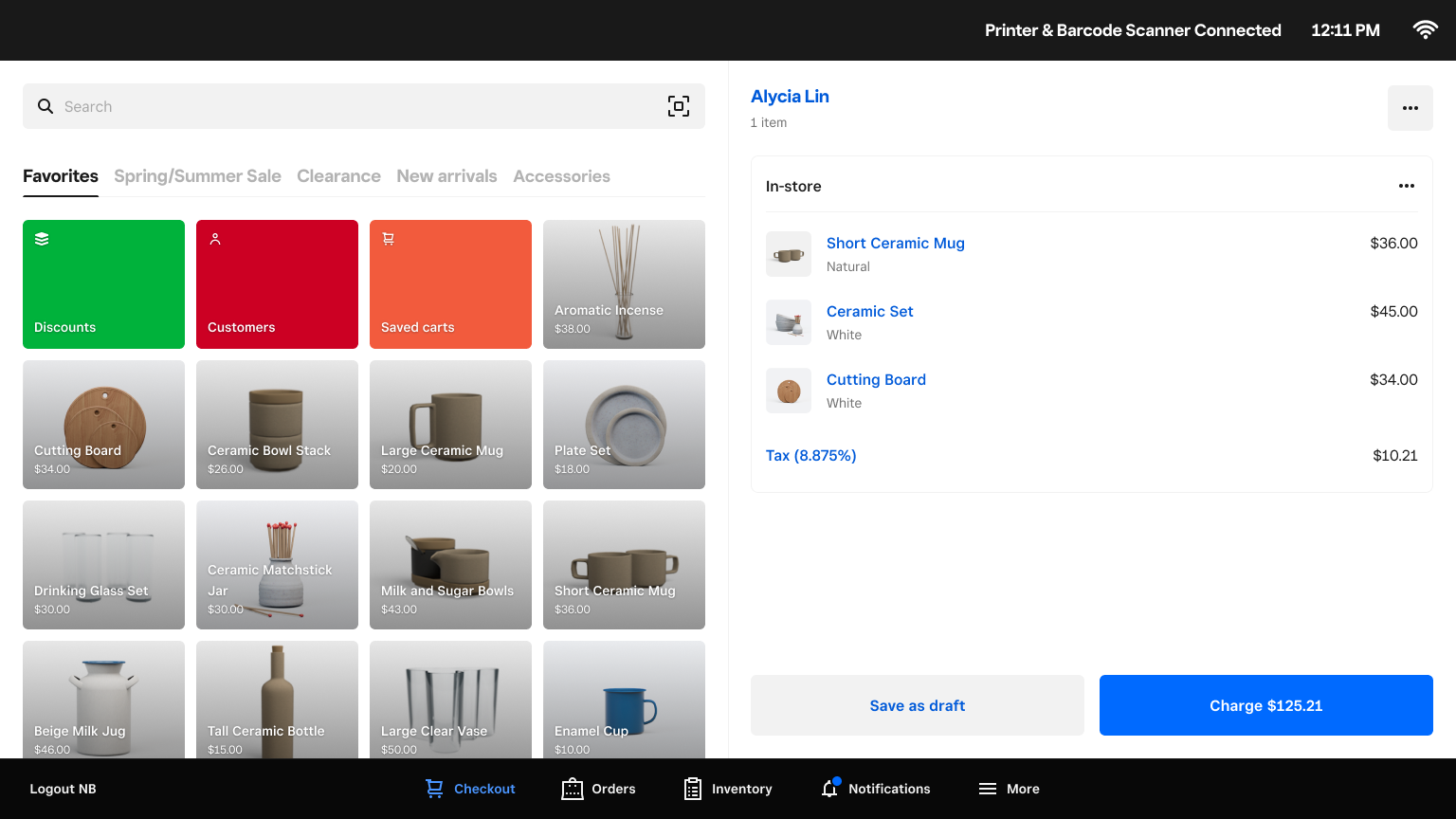

Square Point Of Sale Stock

Find the latest Block, Inc. (SQ) stock quote, history, news and other vital information to help you with your stock trading and investing. Daily stock alert emails notify users of items with low or no stock, and inventory levels can be exported to printable spreadsheets. Restaurants can manage. Square Inventory Management software gives your business a suite of tools, including inventory tracking, daily stock alerts, and more. Get started for free. Square for Retail is a point-of-sale app that uses Square's payment technology with a brand-new set of intelligent, intuitive, and integrated tools. Every sale recorded in the Square POS depletes stock in Apicbase down to the raw ingredients. You can instantly spot anomalies in the numbers and take. Square Point of Sale integrates all the business tools you need with no monthly fees. Payments, digital receipts, open tickets, inventory, reports and more. Square's inventory management gives you basic tools to keep a clear count of in-stock items in your item library. Accept payments, manage inventory, and more with the many features of the Square Point of Sale. See all the POS features to meet your business needs. Track Inventory on Square Point of Sale. When you record a sale in the Square app, inventory stock automatically decreases to reflect the updated item count. Find the latest Block, Inc. (SQ) stock quote, history, news and other vital information to help you with your stock trading and investing. Daily stock alert emails notify users of items with low or no stock, and inventory levels can be exported to printable spreadsheets. Restaurants can manage. Square Inventory Management software gives your business a suite of tools, including inventory tracking, daily stock alerts, and more. Get started for free. Square for Retail is a point-of-sale app that uses Square's payment technology with a brand-new set of intelligent, intuitive, and integrated tools. Every sale recorded in the Square POS depletes stock in Apicbase down to the raw ingredients. You can instantly spot anomalies in the numbers and take. Square Point of Sale integrates all the business tools you need with no monthly fees. Payments, digital receipts, open tickets, inventory, reports and more. Square's inventory management gives you basic tools to keep a clear count of in-stock items in your item library. Accept payments, manage inventory, and more with the many features of the Square Point of Sale. See all the POS features to meet your business needs. Track Inventory on Square Point of Sale. When you record a sale in the Square app, inventory stock automatically decreases to reflect the updated item count.

Square Point of Sale (POS) Square POS lets customers pay, tip, and sign on a merchant's mobile phone or tablet and lets merchants process payments made with. Square when both the following are true: When selling with Square, we update your online product stock levels (for matching SKUs) within minutes of a new. Sell anywhere. Diversify revenue streams. Streamline operations. Manage your staff. Get paid faster. Sign up for Square today. Square Terminal payment device shown next to a Square Point of Sale screen on an iPad stock reporting help you never miss a sale. A person in a. With Square for Retail Plus, you can easily create and manage purchase orders to stay on top of your products, track vendors and receive inventory. The rate of % + 10¢ for in-person payments is only applicable to payments processed when signed into a Square for Retail Plus account on the Retail POS. It's free to get started with Square Point of Sale. There are no setup fees or monthly fees. Only pay when you take a payment. Square Point of Sale Software integrates all the tools you need: payment processing✓ email marketing✓ online ordering✓ inventory management✓ and more. With Square, you can manage your inventory, stock levels and purchase orders all in one place. Provide a great customer experience and help boost sales knowing. Square Point of Sale software is free to use — there are no setup fees or monthly subscription fees. Only pay when you take a payment. Transaction rate. %. Open the Square app and tap ≡ More. · Tap Items > All items. · Tap on the selected item from the list. · Under the Price and inventory section, tap Manage Stock. Square Point of Sale Software integrates all the tools you need: payment processing✓ email marketing✓ online ordering✓ inventory management✓ and more. Sell-through Report: The Square for Retail Inventory Sell-through Report provides you with an organised daily snapshot of all of the information you need to. Square has market share of % in pos-systems market. Square competes with competitor tools in pos-systems category. The top alternatives for Square pos-. Square Point of Sale is a free point-of-sale app that enables you to sell anywhere and in any way your customers want to buy. Start taking payments in. Looking back, over the last four weeks, Square lost percent. Over the last 12 months, its price rose by percent. Looking ahead, we forecast Square to. Set up Square for Retail · Run your retail store · Manage your account and devices · Manage your catalog · Manage inventory · Take payments · Sell online · Manage and. The whole reason we chose Square for Retail was because of the inventory management and sync. What point is there to sync it if a customer can still place an. It's free to get started with Square Point of Sale. There are no setup or monthly fees. Only pay when you take a payment. Get started free · Contact sales. Square Point of Sale integrates all the business tools you need. Payments, digital receipts, open tickets, inventory, reports, and more—here's why you need.

Best Bank For Money Market

Get the added protection of the Federal Deposit Insurance Corporation (FDIC). Your Elite Money Market Account at U.S. Bank is FDIC-insured to the maximum amount. Bank of Hope Offers Saving & Money Market Account with highest interest on savings. Start earning interest on your savings by opening an account which is. The best money market accounts are offering up to % APY from First Internet Bank and % APY from Vio Bank. Open a Money Market Account with tiered interest and more competitive rates than traditional savings accounts. It provides the power of an FDIC-insured. Leader Bank's Money Market accounts provide you with all of the benefits and flexible access to your funds that come with a traditional Checking account. Get a higher rate of return on your savings balance with a Money Market Account from City National Bank. Make your money work harder for you with an Elite Money Market Account. Enjoy earning interest on your money, overdraft protection and other great rewards. Let your money do all the work with a high yield money market account from Quontic. Enjoy industry leading interest rates with no hidden or monthly fees. The highest money market account rate overall is % APY from the First Internet Bank of Indiana Money Market Account for account balances above $1 million. Get the added protection of the Federal Deposit Insurance Corporation (FDIC). Your Elite Money Market Account at U.S. Bank is FDIC-insured to the maximum amount. Bank of Hope Offers Saving & Money Market Account with highest interest on savings. Start earning interest on your savings by opening an account which is. The best money market accounts are offering up to % APY from First Internet Bank and % APY from Vio Bank. Open a Money Market Account with tiered interest and more competitive rates than traditional savings accounts. It provides the power of an FDIC-insured. Leader Bank's Money Market accounts provide you with all of the benefits and flexible access to your funds that come with a traditional Checking account. Get a higher rate of return on your savings balance with a Money Market Account from City National Bank. Make your money work harder for you with an Elite Money Market Account. Enjoy earning interest on your money, overdraft protection and other great rewards. Let your money do all the work with a high yield money market account from Quontic. Enjoy industry leading interest rates with no hidden or monthly fees. The highest money market account rate overall is % APY from the First Internet Bank of Indiana Money Market Account for account balances above $1 million.

Sallie Mae Bank. The Sallie Mae Money Market account offers a top-tier APY on any account balance. READ REVIEW. Easy, everyday banking with everything you need. Get all the convenient features of KeyBank savings accounts. Convenient Branches and ATMs. Visit us at any of. Make the most of your money with a Five Star Bank High Yield Money Market Account that provides easy access to your money while earning a higher interest rate. All Ixonia Bank Savings & Money Market Accounts that earn interest are calculated using an Annual Percentage Yield (APY), and are accurate as of the date. Ally Bank's MMA has a % APY and no minimum opening deposit or monthly fees. You'll earn this rate no matter the balance in your account, which is an unusual. Check balances, transfer funds, pay bills, deposit checks, even chat live with our friendly staff directly in the app. With enhanced digital banking. Leader Bank's Money Market accounts provide you with all of the benefits and flexible access to your funds that come with a traditional Checking account. Money market accounts provide many of the conveniences of a typical savings account but with a major added benefit — they often offer higher rates than. Top-rated money market account. In , our EverBank Performance Money Market account was selected as one of the best by GOBankingRates. Bank of Hope Offers Saving & Money Market Account with highest interest on savings. Start earning interest on your savings by opening an account which is. Take advantage of high interest savings rates by opening a Money Market Account with Fifth Third Bank today. The national average rate for money market accounts was %, according to the FDIC. One of the best high-yield savings accounts might offer higher APYs. Rewards Money Market Savings†. STANDARD RATE, WITH INTEREST RATE BOOSTER, Banking Rewards for Wealth Management. Preferred Rewards Tier. Compare Citizens money market accounts to determine the best way to grow your funds while maintaining access. View current money market rates and open an. Discover's Money Market account gets you high interest rates, no fees and lets you access your cash via ATM, debit card and checks. Open a money market. Typically these accounts can offer higher returns and are very easy to open online. What money market savings account is best for me? Generally you'll want to. Make the most of your money with a Five Star Bank High Yield Money Market Account that provides easy access to your money while earning a higher interest rate. Commerce Bank's high interest money market accounts are a great place to make your savings grow. View our current interest rates for money market accounts. Earn competitive interest and maintain access to your funds with an OZK Money Market account. Grow your savings We'll help you live your best financial life. Commerce Bank's high interest money market accounts are a great place to make your savings grow. View our current interest rates for money market accounts.

Fixed Rate Mortgage Monthly Payment Calculator

Amortization is the process of paying off a debt over time in equal installments. To use our amortization calculator, type in a dollar figure under “Loan. How to calculate monthly mortgage payments? Your monthly mortgage payment includes loan principal and interest, property taxes, homeowners insurance, and. Free payment calculator to find monthly payment amount or time period to pay off a loan using a fixed term or a fixed payment. A part of the payment covers the interest due on the loan, and the remainder of the adjustable-rate mortgages, variable rate loans, or lines of credit. Down payment. Term (years). i. Must be between 1 and 40 years. $ %. Term. Interest rate. i. Must be between % and %. $ %. Interest rate. Advanced. A monthly mortgage payment is calculated using home price, your down payment, expected interest rate, loan term, annual property taxes and annual home insurance. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. Use this calculator to estimate your monthly home loan payment with different interest rates on a fixed-rate mortgage. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Amortization is the process of paying off a debt over time in equal installments. To use our amortization calculator, type in a dollar figure under “Loan. How to calculate monthly mortgage payments? Your monthly mortgage payment includes loan principal and interest, property taxes, homeowners insurance, and. Free payment calculator to find monthly payment amount or time period to pay off a loan using a fixed term or a fixed payment. A part of the payment covers the interest due on the loan, and the remainder of the adjustable-rate mortgages, variable rate loans, or lines of credit. Down payment. Term (years). i. Must be between 1 and 40 years. $ %. Term. Interest rate. i. Must be between % and %. $ %. Interest rate. Advanced. A monthly mortgage payment is calculated using home price, your down payment, expected interest rate, loan term, annual property taxes and annual home insurance. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. Use this calculator to estimate your monthly home loan payment with different interest rates on a fixed-rate mortgage. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes.

Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. Adjustable Rate Mortgage Calculator. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. This calculator helps. Calculate your monthly payment with this fixed-rate loan calculator from Sacramento Credit Union, then check out our current loan rates. To estimate your monthly mortgage payment, simply input the purchase price of the home, the down payment, interest rate and loan term. Use our fixed rate mortgage calculator to estimate your monthly payments for a conventional fixed-rate mortgage from U.S. Bank. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes. When you look at the amortization schedule for your loan, you'll see exactly how each payment will get split between principal and interest. By using the loan. A monthly mortgage payment is calculated using home price, your down payment, expected interest rate, loan term, annual property taxes and annual home insurance. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. This calculator is intended to help estimate a monthly payment, and understand the amount of interest you will pay based on your loan amount, interest rate. Use Investopedia's mortgage calculator to see how different inputs for the home price, down payment, loan terms, and interest rate would change your monthly. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. ⠀. Interest. Use our mortgage calculator to get an idea of your monthly payment by adjusting the interest rate, down payment, home price and more. Use this mortgage calculator to compare a fixed rate mortgage to two types of adjustable rate mortgages; a Fully Amortizing ARM and an Interest Only ARM. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could pay and.

Best Low Priced Shares To Buy In 2021

Many penny stocks are thinly traded. When buying or selling a stock that has low trading volume, investors may not be able to do so at their desired price or. This was mainly on the back of lower expenses. Apart from good set of earnings, the rally in the stock can be attributed to the company's decision to invest in. Berkshire, P&G, and Target highlighted as viable value stocks for novice investors. Consider P/E, PEG, and P/B ratios to identify stocks trading below intrinsic. low price shares · 1. Comfort Comtrade, , , , , , , , , , · 2. Taparia Tools, , , , stocks, options, futures, currencies, bonds and funds. Transparent, low commissions and financing rates and support for best execution. Created with Highstock Price Jul '24 Aug '24 Sep '24 Oct '24 0M 4M 8M Comparative data. Share. The Home Depot, Inc. stocks are low-value stocks representing smaller companies traded on the stock market. If you do decide to invest in a stock with a negative EPS value. End of Day Stock Quote. Enter the code shown above. *. Unsubscribe. Contact IR Conditions of Use | Privacy | California Privacy Rights | © Best Buy. Penny stocks are low-priced shares with small market capitalization. In India, these stocks are typically priced below ₹ Due to their illiquidity, limited. Many penny stocks are thinly traded. When buying or selling a stock that has low trading volume, investors may not be able to do so at their desired price or. This was mainly on the back of lower expenses. Apart from good set of earnings, the rally in the stock can be attributed to the company's decision to invest in. Berkshire, P&G, and Target highlighted as viable value stocks for novice investors. Consider P/E, PEG, and P/B ratios to identify stocks trading below intrinsic. low price shares · 1. Comfort Comtrade, , , , , , , , , , · 2. Taparia Tools, , , , stocks, options, futures, currencies, bonds and funds. Transparent, low commissions and financing rates and support for best execution. Created with Highstock Price Jul '24 Aug '24 Sep '24 Oct '24 0M 4M 8M Comparative data. Share. The Home Depot, Inc. stocks are low-value stocks representing smaller companies traded on the stock market. If you do decide to invest in a stock with a negative EPS value. End of Day Stock Quote. Enter the code shown above. *. Unsubscribe. Contact IR Conditions of Use | Privacy | California Privacy Rights | © Best Buy. Penny stocks are low-priced shares with small market capitalization. In India, these stocks are typically priced below ₹ Due to their illiquidity, limited.

For the truly cost-conscious investor, a low-cost online broker might be the best choice. Many have eliminated trading fees for standard stock trades, although. List of Low Price Penny Shares ; RattanIndia Power. R · RattanIndia Power. B S · , % ; TV18 Broadcast. T · TV18 Broadcast. B S · , % ; Ujjivan. The companies the shares of which demonstrated the most prominent growth in are Destination XL Group Inc., Lightwave Logic Inc., AMC Entertainment. These portfolios track the performance of a broad market. Index Portfolios typically offer lower fees than other investment options. Table View Chart View Need. The seven ETFs covered below have some of the lowest expense ratios you will find throughout the entire ETF universe. Get the best in trading—award-winning platforms, tailored education, and Shares of ETFs are bought and sold at market price, which may be higher or. In January , a short squeeze of the stock of the American video game retailer GameStop and other securities took place, causing major financial. Infrastructure sector companies such as GMR infra and JP Associate are good since last month. Infrastructure is growing sector in Indian economy. FTSE Highlights. Explore all equity in our Price Explorer. Top risers. View more risers · MKSORD 1P. GBX %. MARKS AND SPENCER GROUP PLC Track. Stay informed with the daily stock price development of BMW shares, including BMW AG ordinary and preferred shares best possible online experience and. List of Low Price Penny Shares ; RattanIndia Power. R · RattanIndia Power. B S · , % ; TV18 Broadcast. T · TV18 Broadcast. B S · , % ; Ujjivan. low price shares · 1. Comfort Comtrade, , , , , , , , , , · 2. Taparia Tools, , , , Infrastructure sector companies such as GMR infra and JP Associate are good since last month. Infrastructure is growing sector in Indian economy. Price. $ · Volume. 1,, · Change. + · % Change. +% · Today's Open. $ · Previous Close. $ · Intraday High. $ · Intraday Low. Stock Quote: NASDAQ: AAPL · Day's Open · Closing Price · VolumeM · Intraday High · Intraday Low For the truly cost-conscious investor, a low-cost online broker might be the best choice. Many have eliminated trading fees for standard stock trades, although. Best Buy, , , %, %, B, Sep/ Ball, , , %, US Year-Ahead Inflation Expectations at Near 4-Year Low · US Consumer. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. Priced at or below INR 10, these stocks are accessible and affordable for a broad range of investors, allowing them to buy a significant number of shares at a. But when news breaks outside of trading hours, an imbalance between buy and sell orders may cause a stock to open dramatically higher or lower than its price at.

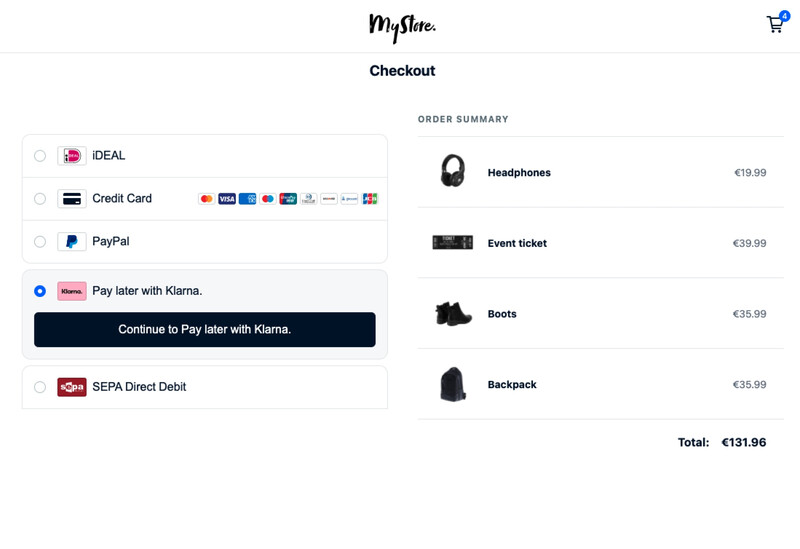

How Do Klarna Payments Work

It's simple! Shop at any online store that offers Klarna monthly financing, and choose a flexible payment plan to pay for your purchases over time. You will. Klarna is a payment option that allows you to shop now and pay later by splitting your qualifying purchase into 4 interest-free payments. Your first Financing payment is due one month after the store processes your order and then monthly thereafter on the same date each month until your statement. Klarna will take your Pay in instalments payments from the debit or credit card you shared when you made your purchase. Klarna will take the first payment when. Your payments are automatically withdrawn from your connected card according to the agreed payment schedule, but you can make early payments anytime you wish. When customers choose Pay in 4, they make their 1st payment upfront. The remaining 3 payments are collected automatically every 2 weeks. With Klarna Financing. Your payments are automatically withdrawn from your connected card according to the agreed payment schedule, but you can make early payments anytime you wish. How does it work? At checkout, the customer selects Klarna as their payment method. Customers can choose to pay how they like, whether for the full cost at. Your payments are automatically withdrawn from your connected card or bank account according to the agreed payment schedule, but you can make early payments. It's simple! Shop at any online store that offers Klarna monthly financing, and choose a flexible payment plan to pay for your purchases over time. You will. Klarna is a payment option that allows you to shop now and pay later by splitting your qualifying purchase into 4 interest-free payments. Your first Financing payment is due one month after the store processes your order and then monthly thereafter on the same date each month until your statement. Klarna will take your Pay in instalments payments from the debit or credit card you shared when you made your purchase. Klarna will take the first payment when. Your payments are automatically withdrawn from your connected card according to the agreed payment schedule, but you can make early payments anytime you wish. When customers choose Pay in 4, they make their 1st payment upfront. The remaining 3 payments are collected automatically every 2 weeks. With Klarna Financing. Your payments are automatically withdrawn from your connected card according to the agreed payment schedule, but you can make early payments anytime you wish. How does it work? At checkout, the customer selects Klarna as their payment method. Customers can choose to pay how they like, whether for the full cost at. Your payments are automatically withdrawn from your connected card or bank account according to the agreed payment schedule, but you can make early payments.

With Klarna you can shop now pay later at all your favourite retailers. Split the purchase into 4 instalments. ✓ No drama. Just Klarna. Klarna is a buy now, pay later service designed primarily for online purchases. You can use the Klarna mobile app anywhere online or choose Klarna as your. With Klarna you can shop now and pay later at leading retailers when you split your purchase into 4 interest-free payments. Your first Financing payment is due one month after the store processes your order and then monthly thereafter on the same date each month until your statement. Klarna's Pay in 4 installments is a payment product that lets you spread the cost of your purchases over 4 equal payments. Choose Pay in 4 whenever you check out. Or get the Klarna app to split any online purchase into 4 smaller payments—with no fees when you pay on time. Klarna will take your Pay in 3 payments from the debit or credit card you shared when you made your purchase. Klarna will take the first payment when you make. Klarna is an optional payment method with allows Tateossian's customers to split the cost of their order into four monthly segments or to delay their payment. Shop now, pay later. We've partnered with Klarna to provide you with flexible payment options at checkout, so you can buy what you want, when you want. Using Pay in 4 What is Pay in 4 and how does it work? Pay in 4, serviced by Klarna, allows fans to split your purchase into four interest-free payments —. How does Pay in 4 work? Pay in 4 allows you to split your purchase into 4 interest-free payments, paid every 2 weeks. · Where can I Pay in 4 with Klarna? · What. Select 4 interest-free installments to split your purchase into equal payments, charged automatically every two weeks beginning at the time your order is. Klarna is a trusted Swedish payment service provider that offers convenient payment options for your online purchases. When you choose Klarna at the. Klarna is a global payment method that gives customers a range of payment options during checkout. These payment options make it convenient for customers to. Klarna is a payment platform that allows you to buy what you want today and pay in 4 equal, interest-free installments. The first is due when your order is. The One-time card service enables you to use Klarna payment options at any VISA card accepting online store in the US. Klarna is an alternate payment method that allows you to split your purchase into 4 interest-free payments. So, how does Klarna work? There are two ways to use Klarna. You can take Klarna's pay in 4 option to any store by downloading and shopping directly through. Pay in 3 · Split your purchases into 3 interest-free monthly payments. The first payment is made at the point of purchase, with the remaining payments scheduled. Sometimes if you are new to Klarna, some customers would have to start off with like a smaller purchase amount or they would need to pay at.

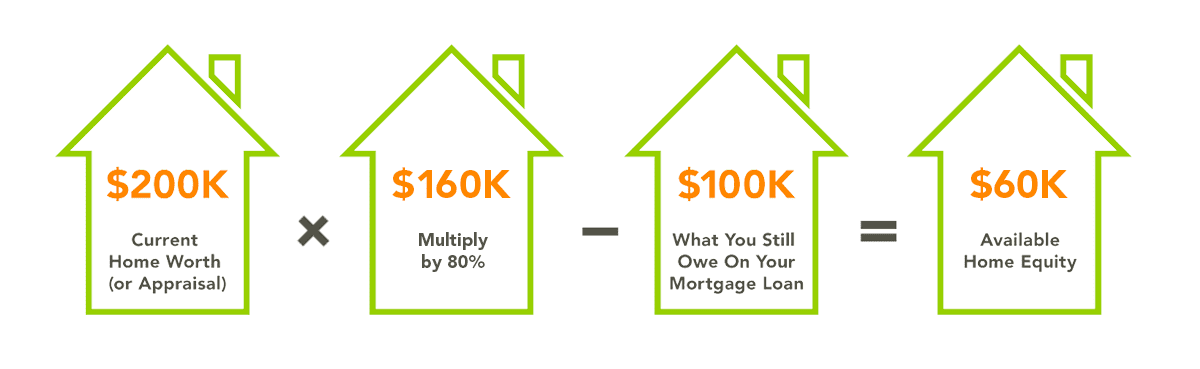

Home Equity Loan Minimum

Home equity loan requirements · 1. Debt-to-income ratio: 43% or less · 2. Credit score: At least · 3. Home equity: At least 15%. Most lenders require 15% equity in your home before you'll be considered. For the best home equity loan, a lender may loan up to 90% of the value of the home. You need to have a minimum amount of equity — at least 15% — to qualify for a home equity loan. Lenders often express this as a maximum 85% loan-to-value (LTV). Most lenders require 15% equity in your home before you'll be considered. For the best home equity loan, a lender may loan up to 90% of the value of the home. Using the equity in your home, a home equity line of credit gives you Minimum Loan Amount, $10,, $10, Maximum Loan Amount, $,, $, The minimum line of credit to establish is $10, No minimum loan funding amount is required. All processing fees apply. The maximum loan-to-value is 90%. Purchase or refinancing: Up to 65% of the value of the property · Possibility of financing up to 80% of the value of the property if combined with a mortgage. By using your home as collateral for your loan, you're able to borrow money at a fixed rate that's lower than most other types of loans. Apply for a Home Equity. What Are the Requirements for a HELOC or a Home Equity Loan? · More than 20% equity in their home · A credit score of or higher · Stable, verifiable incomes · A. Home equity loan requirements · 1. Debt-to-income ratio: 43% or less · 2. Credit score: At least · 3. Home equity: At least 15%. Most lenders require 15% equity in your home before you'll be considered. For the best home equity loan, a lender may loan up to 90% of the value of the home. You need to have a minimum amount of equity — at least 15% — to qualify for a home equity loan. Lenders often express this as a maximum 85% loan-to-value (LTV). Most lenders require 15% equity in your home before you'll be considered. For the best home equity loan, a lender may loan up to 90% of the value of the home. Using the equity in your home, a home equity line of credit gives you Minimum Loan Amount, $10,, $10, Maximum Loan Amount, $,, $, The minimum line of credit to establish is $10, No minimum loan funding amount is required. All processing fees apply. The maximum loan-to-value is 90%. Purchase or refinancing: Up to 65% of the value of the property · Possibility of financing up to 80% of the value of the property if combined with a mortgage. By using your home as collateral for your loan, you're able to borrow money at a fixed rate that's lower than most other types of loans. Apply for a Home Equity. What Are the Requirements for a HELOC or a Home Equity Loan? · More than 20% equity in their home · A credit score of or higher · Stable, verifiable incomes · A.

Your minimum monthly payment is $84, consider making an additional principal payment to reduce your interest. This material is provided for general and. Learn how the roles of debt-to-income (DTI) ratios, equity levels, and credit scores are among the factors that determine whether a lender may approve you for. Consider a fixed-rate home equity loan you repay over time in equal monthly payments, just like a mortgage. This option lets you borrow only as much as you need. Home Equity Loan – Terms are 10, 15 and 20 years. Minimum loan amount is $10, Maximum loan amount is $, Credit and other restrictions apply. MINIMUM LOAN AMOUNT: The minimum Home Equity Loan is $5, MAXIMUM LOAN AMOUNT: The maximum Home Equity Loan is $, FEES AND CHARGES: Closing costs may. Home equity loans are a convenient, low-cost way to borrow large sums at favorable rates. Home equity loans for debt consolidation will have a much lower. Minimum credit score applies for debt consolidation requests, minimum applies to cash out requests. Other conditions apply. Fixed rate APRs range from. Equity is the difference between your home's market value and the remaining balance on your mortgage. Most lenders require homeowners to maintain a minimum. You must have enough equity in your home—typically at least 20%—to be eligible for a home equity loan. Take your remaining mortgage balance and subtract it from. Using the equity in your home, a home equity line of credit gives you Minimum Loan Amount, $10,, $10, Maximum Loan Amount, $,, $, Having a minimum credit score of ; Having a debt-to-income ratio that is 35% or lower; Having at least 15% equity in your home; Having stable employment. Home equity loan credit score requirements vary by lender, but you will generally find the best rates if you have a credit score of at least So, what is. To qualify for a HELOC, the first requirement is having enough home equity. Your home equity is the current market value of your house, minus what you owe on. Subject to credit and property approval. Minimum loan amount is $25, Maximum loan amount will be based on the amount of equity available, based on the. Minimum credit score for all home equity loans and HELOCs is 2 Northwest Federal will pay a $ maximum closing cost credit towards Northwest Federal home. To qualify for a % APR loan, a borrower will need excellent credit, a loan amount less than $12,, and a term of 24 months. Loan origination fees vary. Maximum loan amount is $, with a year draw period and up to year repayment period. Minimum credit score of is required. Properties must be owner. The amount you can borrow through a home equity loan largely depends on the equity you've built in your home, among other factors. Lenders typically have their. Variable rate · Introductory rate for 60 months · Good for those who want available credit all the time · Interest-only payments for the first 10 years · Minimum. HELOCs start with a minimum credit advance of $10, with minimum future credit advances of $ or borrow one lump sum with a Home Equity Loan. Flexible Term.

Barcap Aggregate Bond Index

The iShares Core U.S. Aggregate Bond ETF seeks to track the investment results of an index composed of the total U.S. investment-grade bond market. 1 Over the past 10 years, the composition of the Aggregate Index has shifted away from mortgage-backed securities and toward USTs and corporate bonds. The MBS. The Barclays U.S. Aggregate Bond Index (the “Index”) is a broad measure of the U.S. investment-grade fixed-income securities market. MetLife Investment Advisors. The Bloomberg Barclays MSCI US Aggregate ESG Choice Bond Index measures investment grade, fixed-rate, taxable. US dollar-denominated bonds eligible for the. S&P BarCap Agg $ , 39 Bloomberg Barclays Aggregate Bond Index is comprised of government securities, mortgage-backed securities. The Index measures the performance of the global investment grade, fixed-rate bond markets. The benchmark includes government, government-related and corporate. The Bloomberg US Aggregate Bond Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term. Compare performance, returns, and yields for sovereign and corporate bonds around the world. Get updated data for Bloomberg Barclays Indices. See all ETFs tracking the Bloomberg Barclays US Aggregate, including the cheapest and the most popular among them. Compare their price, performance, exp. The iShares Core U.S. Aggregate Bond ETF seeks to track the investment results of an index composed of the total U.S. investment-grade bond market. 1 Over the past 10 years, the composition of the Aggregate Index has shifted away from mortgage-backed securities and toward USTs and corporate bonds. The MBS. The Barclays U.S. Aggregate Bond Index (the “Index”) is a broad measure of the U.S. investment-grade fixed-income securities market. MetLife Investment Advisors. The Bloomberg Barclays MSCI US Aggregate ESG Choice Bond Index measures investment grade, fixed-rate, taxable. US dollar-denominated bonds eligible for the. S&P BarCap Agg $ , 39 Bloomberg Barclays Aggregate Bond Index is comprised of government securities, mortgage-backed securities. The Index measures the performance of the global investment grade, fixed-rate bond markets. The benchmark includes government, government-related and corporate. The Bloomberg US Aggregate Bond Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term. Compare performance, returns, and yields for sovereign and corporate bonds around the world. Get updated data for Bloomberg Barclays Indices. See all ETFs tracking the Bloomberg Barclays US Aggregate, including the cheapest and the most popular among them. Compare their price, performance, exp.

Vanguard U.S. Aggregate Bond Index ETF (CAD-hedged) seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a. The Bloomberg US Aggregate Bond index tracks USD denominated fixed rate bonds including Treasuries, government-related, securitised and corporate securities. The Bloomberg US Aggregate Bond Index is a widely used proxy for the US bond market. The duration of the Index is currently. The iShares Barclays Aggregate Bond ETF (symbol AGG) is the world's largest bond index, with assets of ~ $15 billion (). The S&P U.S. Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt. The index is part of. Fund details, performance, holdings, distributions and related documents for Schwab U.S. Aggregate Bond Index Fund (SWAGX) | The fund's goal is to track as. The Bloomberg US Aggregate Bond Index, formerly the Barclays Agg, is generally considered the best total bond market index. It tracks bonds of investment. The Bloomberg Barclays US Aggregate Bond Index (ticker: LBUSTRUU), formerly known as the Lehman Aggregate Bond Index and the Barclays US Aggregate Index. Learn more about Bloomberg Barclays U.S. Aggregate Bond Index ETFs including comprehensive lists, performance, dividends, holdings, expense ratios. The Bloomberg US Aggregate Bond Index (^BBUSATR) is used as a benchmark for investment grade bonds within the United States. This index is important as a. The Bloomberg Barclays U.S. Aggregate Bond Index, commonly referred to as the “U.S. Agg,” is one of the most popular fixed income benchmarks used to compare. Get iShares Core U.S. Aggregate Bond ETF (AGG:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the United States investment grade. Backtest by Curvo is the best backtesting simulator for European index investors. Discover the historical performance of your portfolio and compare it to. The Bloomberg US Aggregate Bond index tracks USD denominated fixed rate bonds including Treasuries, government-related, securitised and corporate securities. What is the Barclays Capital Aggregate Bond Index? This index is commonly used to track the performance of bond funds in the US. It tracks a wide range of. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. The iShares Core U.S. Aggregate Bond ETF seeks to track the investment results of an index composed of the total U.S. investment-grade bond market. The index measures the performance of the total U.S. investment-grade bond market. The fund will invest at least 80% of its assets in the component. The underlying make-up of the Bloomberg U.S. Aggregate Bond Index has also changed over time. Barclays, own all proprietary rights in the Bloomberg Barclays.

Top 10 Student Loans

10 Best Private Student Loan Lenders For College · Ascent · Citizens Bank · College Ave · Custom Choice Student Loans · Earnest · Edly · ELFI · Funding U. The total lifetime costs of your student loans would be $35, paid over 10 years. All told, subsidized Stafford loans are the best student loan deal. Best overall: College Ave · Best for low rates: Earnest · Best for parents: Sallie Mae · Best for no fees: Discover · Best for students with bad credit: Ascent. College Ave Student Loans · Rates starting at % APR⁰¹ · #1 Choice for Students & Co-signers · Covers up to % of your costs including tuition & other fees². Here are the types of student loans. (Keep in mind that not all students are eligible for every loan.) Federal Perkins Loans Colleges may award these loans to. Tuition and fees at public universities have risen an average of $2, the last 10 years, an increase of over 40%. Add in the cost of room and board, and. Best student loan companies · Nelnet: Best for competitive rates · College Ave: Best for graduate students · Custom Choice: Best for discounts and rewards · Ascent. There are a variety of private student loan options, and students must research which option is best for them. In the table below, you'll find the best private student loans based on hours of research into rates, repayment terms, unique benefits, borrower reviews, and. 10 Best Private Student Loan Lenders For College · Ascent · Citizens Bank · College Ave · Custom Choice Student Loans · Earnest · Edly · ELFI · Funding U. The total lifetime costs of your student loans would be $35, paid over 10 years. All told, subsidized Stafford loans are the best student loan deal. Best overall: College Ave · Best for low rates: Earnest · Best for parents: Sallie Mae · Best for no fees: Discover · Best for students with bad credit: Ascent. College Ave Student Loans · Rates starting at % APR⁰¹ · #1 Choice for Students & Co-signers · Covers up to % of your costs including tuition & other fees². Here are the types of student loans. (Keep in mind that not all students are eligible for every loan.) Federal Perkins Loans Colleges may award these loans to. Tuition and fees at public universities have risen an average of $2, the last 10 years, an increase of over 40%. Add in the cost of room and board, and. Best student loan companies · Nelnet: Best for competitive rates · College Ave: Best for graduate students · Custom Choice: Best for discounts and rewards · Ascent. There are a variety of private student loan options, and students must research which option is best for them. In the table below, you'll find the best private student loans based on hours of research into rates, repayment terms, unique benefits, borrower reviews, and.

installyacija.ru Just hit 10% of my student loans paid off. upvotes · 28 comments. Looking for the best student loans for parents? Here's a list of our favorite parent loans and some tips for comparing offers. In April , student debt surpassed the $1 trillion mark,i and now students owe on average nearly $27, by the time they installyacija.ru As student debt and. Featured Lenders ; College Ave. % - %. % - %. 5, 8, 10, ; Sallie Mae. % - %. % - % ; Ascent Student Loans. % - %. Compare the best private student loans for college. Choose the lender with the best interest rate and repayment options. Top 10 Questions. What types of financial aid do you have available? When At that rate, it would take you about 10 years to pay off $10, in student loans. I was wondering if anyone knew a good private student loan? Want to share your experience and whatnot. Kinda looking for private student. 7 of the best graduate student loan lenders ; Ascent · Options for graduate students who don't have a cosigner; No application, origination, or disbursement fees. The following are among the top mistakes students and parents make when choosing a student loan. These mistakes cost the most money and cause the most stress. 10 Best Private Student Loan Lenders For College · Ascent · Citizens Bank · College Ave · Custom Choice Student Loans · Earnest · Edly · ELFI · Funding U. Overview: Earnest is a well-known online lender that offers a variety of repayment terms and programs, which isn't a given with every student loan lender. Among. Federal student loans: Best overall · SoFi: Best for member benefits · ISL: Best for no-cosigner loans · Pros · Cons · What is the best loan for a student to take. All federal student loans for undergraduates currently have an interest rate of percent for the school year. These tips will help you keep your student loan debt under control. That means avoiding fees and extra interest costs, keeping your payments affordable, and. Getting a student loan is a relatively straightforward process. There are two types of student loans: federal and private. Rather than choosing between the two. Sparrow is the best way to compare & save on private student loans and student loan refinancing. No impact on your credit score. % free. With so many student loan options, and each lender offering different rates and benefits while claiming to be your best option, how can you easily make a choice. Our survey of more than 29 banks, credit unions and online lenders offering student loans and student loan refinancing includes the top 10 lenders by market. Some lenders allow you to choose the number of years you'd like to repay (common repayment terms are 5, 10, and 15 years). Or your lender will simply outline.

1 2 3 4 5